Tepid growth outlook and new headwinds such as rupee appreciation have made mutual fund (MF) managers wary of the information technology (IT) sector.

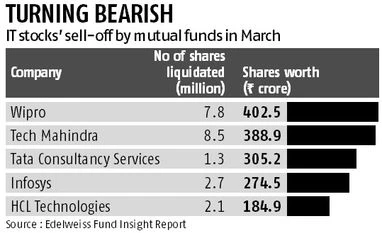

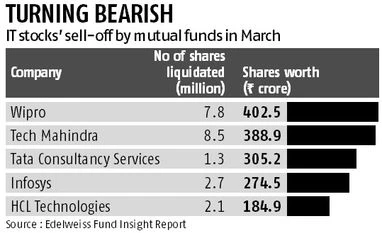

Money managers, who have already been underweight on the sector, were seen further pruning their exposure to the country’s top IT stocks. Last month, investment managers liquidated shares worth Rs 1,550 crore in IT companies. The stand was vindicated after IT bellwether Infosys had a tepid March quarter and disappointed with its revenue guidance.

Fund managers have turned bearish on the IT pack due to multiple headwinds such as stricter US visa policy, lower order flows, and sharp appreciation in the rupee.

Wipro emerged as the most-sold stock, with fund managers offloading nearly eight million shares worth Rs 403 crore. It was followed by Tech Mahindra (Rs 389 crore), Tata Consultancy Services (Rs 305 crore) and Infosys (Rs 275 crore).

India’s largest fund house ICICI Prudential Mutual Fund took an aggressive call to cut exposure to Infosys. The fund house sold its shares worth Rs 580 crore. On the other hand, HDFC Mutual Fund’s major reduction in the sector was HCL Technology as it sold shares worth Rs 200 crore. Franklin Templeton Mutual Fund reduced its allocation to Tata Consultancy Services and liquidated shares worth Rs 113 crore. Interestingly, Reliance Nippon Mutual Fund added more of HCL Technology shares worth Rs 167 crore during March.

Neelesh Surana, equity head at Mirae Asset Mutual Fund, says, “We have been underweight on IT for nearly two years now. The growth trajectory for the sector is coming down and recent rupee movement is not favouring the sector at large. At current times, they have slipped to a level where it appears further big downside is protected. Some IT counters may trigger buying interest at these levels.”

Shares of all the top IT majors are trading 10-30 per cent lower than their 52-week high. Infosys and Tech Mahindra are hit the worst as their shares have plunged 28 per cent and 25 per cent, respectively, against their one-year high.

“With the exception of Infosys, equity MFs don’t have substantial exposure to the IT sector. Recent selling is more of a directional than a strategic call for many of us,” explains chief investment officer (CIO) of a mid-sized fund house.

“Cautious view continues on IT sector. Issues of H1B visa and weak order flows have been discounted in the prices. However, the sudden strength in the rupee may not be priced in fully. There may not be immediate uptick in growth prospects for IT companies. Doubt remains if the domestic IT leaders will sustain their position on the global map given the fast-changing scenario. Higher payout may not help battle the weak investor sentiment,” said Ambareesh Baliga, an independent market expert.

)

)