Offshore funds, a win-win for industry, investors

Sneha Padiyath Mumbai With domestic equity markets losing sheen, mutual funds are increasingly looking outside India for investment opportunities. In the last one-year, close to two dozen offshore funds have been launched to capture the turnaround in the international markets, and many more are lining up for approval from the regulator.

Offshore fund-of-funds are feeder funds which invest in equity funds in the US, Europe and the emerging markets. These funds are available to both retail and high networth individuals (HNI). However, fund houses feel these products are more suited for savvy HNI investors who have a better understanding of the global markets.

Fund analysts said that it was the underperformance of the Indian markets vis-à-vis its global peers in the last one-year that led to the rise in demand for these products.

"Of late, the rupee depreciation has given good returns to investors. Also markets like the US and Europe have done well. So large investors have been looking at opportunities outside India," said R S Srinivas Jain, executive director and chief marketing officer, SBI Mutual Fund.

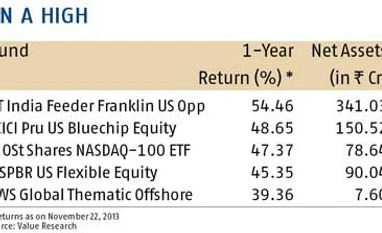

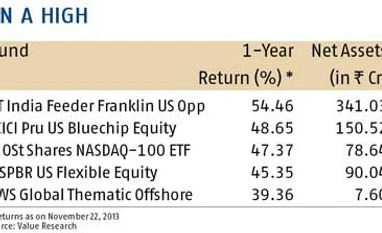

While Indian equity indices have been a victim of a weakening currency and faltering economy coupled with fears over an early end to US Federal Reserve's tapering, the US and European markets have been showing signs of a turnaround. The offshore fund category in the last three years has given average returns of about 6 per cent, according to Value Research data.

Fund analysts said that besides cashing in on the rise in the developed markets, investing in these funds is also part of a diversification of their investment portfolio.

"There is an increasing sense of disenchantment with Indian equities which is making investors look for equity opportunities outside," said Sunil Mishra, CEO, Karvy Private Wealth.

The rupee stabilising at 60-63 levels versus the US dollar was another incentive for investors to look outside.

The increasing interest in the offshore funds is visible through the rising number of HNI folios in this category. According to data on the Association of Mutual Funds in India website, the number of folios held by HNIs under the offshore funds category rose by 15 per cent in the six-month period ending September 2013, compared to the previous six months which saw an 11 per cent drop in total folios.

The assets under management (AUM) of these funds in the six-month period ending September 2013 rose by about 22 per cent to Rs 1,237 crore. In the preceding six months, the AUM was down 10.5 per cent at Rs 1,017 crore.

The total number of HNI folios in the offshore category stood at 8,405 folios as at end September, up by 1,118 folios from the previous quarter. HNI folios at the end of the March 2013 quarter stood at 8,210 folios.

Fund managers said that it was largely Indian equity money that was being channelled into these funds. They added that HNIs would continue to avoid Indian equity until the elections.

"The US markets have hit an all-time high but there are still downside risks in terms of the tapering of the QE3 and the jobs data which still look a little unstable. This is the reason why Europe looks much better placed than the US," said Ankit Swaika, SVP and head-investment advisory and research, Religare Macquarie Wealth Management.

Recently, JP Morgan and Religare Invesco filed for Europe-focused equity offshore funds. Reliance has also filed a Japanese equity fund.

)

)