Parag Milk IPO positives priced in

Continued investments in facilities, products and branding will keep profitability

Sheetal Agarwal Mumbai Parag Milk Foods is an integrated dairy player with key brands such as Go, Govardhan, Topp Up and Pride of Cows. Focus on the healthier cow milk and value-added dairy products along with under-penetration of organised players are key positives and will aid the company's growth over the next few years.

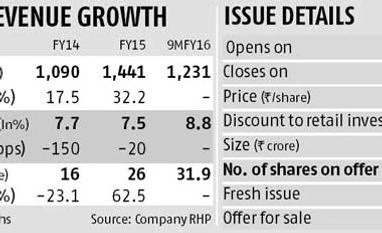

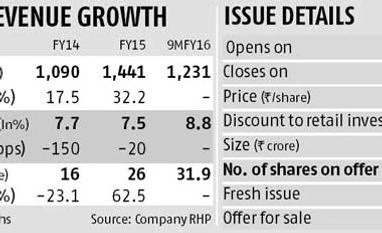

However, valuations of 27-28 times FY17 estimated earnings based on the equity capital after the initial public offering (IPO) — after discount of Rs 12 per share to retail/employees — appear to be on the higher side. Notably, this is after assuming a higher earnings growth rate of 50 per cent for FY17 considering its recent earnings growth track-record as well as potential savings on interest costs after the IPO.

Read more from our special coverage on "IPO"

Although not strictly comparable, peers such as Prabhat Dairy and Hatsun Agro are trading at 20 times and 28 times their FY17 estimated earnings, respectively. While Hatsun’s revenue was double that of Parag, Prabhat’s was about 30 per cent lower than Parag’s revenues in FY15. Prabhat Dairy also enjoys higher earnings before interest, taxes, depreciation and amortisation (Ebitda) margin than Parag given that it is largely a business-to-business (B2B) player with about 75 per cent of its revenues coming from non-retail segment.

Parag, on the other hand, derives just 12 per cent of its revenues from this space. Parag's Ebitda margin of 8.8 per cent, though, is comparable with other retail-focused players such as Hatsun Agro. However, this is despite the fact that Parag’s share of value-added products in total revenues is far higher than its peers. The lower margins can be attributed to Parag’s high investments in branding and having its own marketing and distribution reach. Also, given the high competition in branded space, pricing power is limited.

While the company's strategy of expanding its value-added portfolio is exciting, it operates in a highly competitive industry with biggies such as Amul also growing its cheese and other value-added products. Parag will also need to continuously invest in advertising and brand-building activities going forward, which will keep a check on its profitability and return ratios in the near term.

Of the issue proceeds, Rs 300 crore will flow into the company's books with the rest being offer for sale. Of this, one-third will be deployed towards part repayment of Parag's debt, Rs 148 crore for expansion and modernisation of existing manufacturing facilities, Rs 2.3 crore for investment in Bhagyalaxmi Dairy farm and the rest for general corporate purposes. After the issue, the company's debt-equity ratio will come down from 1.6 times to 0.5 times and add to overall earnings.

Expansion of its value-added portfolio (57 per cent of revenues), which comprises ghee, cheese/paneer, whey products and flavoured milk, among others, is a key growth strategy for Parag. While its ghee products (under Govardhan brand) continue to witness healthy traction, the company believes cheese will be another fast-growing product going forward.

In addition to cheese sold in retail outlets, Parag is also focusing on growing the hotels, restaurants and canteen (HORECA) segment to boost cheese sales. It currently supplies cheese to prominent quick service restaurants such as Dominos, Pizza Hut and KFC. Notably, its peers such as Prabhat Dairy, too, are aggressively looking at growing their revenues from the HORECA segment. Parag provides whey powder (1.6 per cent of revenues) to larger players such as Nestle and believes that this product holds a lot of promise.

Strong distribution network, well recognised brands, fully integrated business model and rich management experience are some of Parag's key strengths. Rising competition in all segments and entry of big conglomerates such as Mahindras, Godrej group and ITC in the dairy segment is a key downside risk. The management's sound track record so far provides some comfort. In this backdrop, investors with a longer-term horizon may consider the issue at the lower price band.

)

)