PNB Housing IPO subscribed 30 times on final day

At the end of the day, the institutional category was subscribed 86.2 times

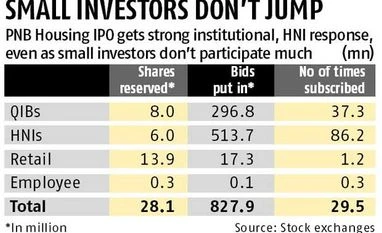

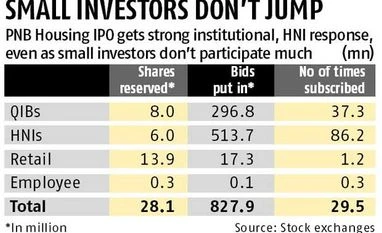

Pavan Burugula Mumbai The Rs 3,000-crore initial public offering (IPO) of PNB Housing Finance was subscribed nearly 30 times on Thursday, the final day of the issue, as institutional investors and high net worth individuals (HNIs or wealthy persons) bid aggressively for the allotment. At the end of the day, the institutional quota was subscribed 86.2 times while the HNI quota was subscribed close to 68 times. The entire offering is a fresh issue of shares.

Similar enthusiasm was absent from the retail (small investor) category. This portion was subscribed a little more than 1.2 times. Market participants said this lukewarm response was due to a cautious approach adopted by small investors after some big-ticket IPOs this year failed to provide good listing-day gains. The most recent being the IPO of private firm ICICI Prudential Life Insurance, whose stock slumped more than 10 per cent on listing day.

Strong support from institutional and wealthy investors comes after several brokerages gave positive reviews of the issue, citing reasonable valuation and good growth potential. At a price band of Rs 750-775 a share, the IPO is priced at 2.3-2.5 times the company's FY16 book value or net worth (adjusted for post-issue book value). Listed peers Gruh Finance and Can Fin Homes trade at much higher valuations.

Earlier during the week, PNB Housing Finance raised Rs 900 crore by allotting shares to various anchor investors. The allotment was done at Rs 775 apiece, which is the peak of the price band. Kotak Investment Banking, Bank of America Merrill Lynch, JM Financial, JPMorgan, and Morgan Stanley are the book-running lead managers for the issue.

The company intends to use the proceeds for raising its capital base to meet the Tier-I capital requirements for FY17 and FY18.

Founded by state-owned Punjab National Bank (PNB), the company is the fifth-largest home loan provider in the country. Before the IPO, the bank owned 51 per cent stake in PNB Housing Finance while the rest was owned by US-based private equity fund Carlyle Holdings.

)

)