Profit-booking pulls gold down marginally

Ratio trading triggers further decline, but economic numbers and geo-political tensions to decide its move further

Dilip Kumar Jha Mumbai Gold failed to breach the technical resistance level of $1,330/oz in global markets due to profit-booking by investors who were wary ahead of key economic data to be presented next week in the US, EU and China.

The commodity saw buying support amid geopolitical tensions, particularly US air strikes in Iraq the crisis in Ukraine. It hit a three-month high in London, as well as on the New York Mercantile Exchange (Nymex). On the Nymex, it hit $1,322.10 an oz in early trade on Friday, before closing at $1,311 an oz, a weekly gain of 1.25 per cent.

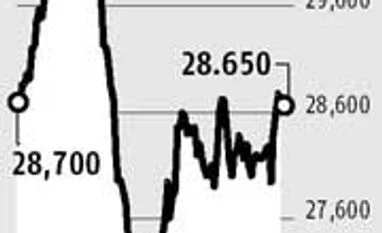

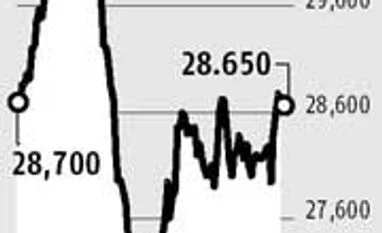

Silver for delivery in September fell 2.1 per cent to $19.94 an oz. After surpassing the benchmark level of Rs 29,000/10g in India on Friday, gold fell on Saturday to Rs 28,650/10g, a marginal decline 0.42 per cent compared to the previous close.

“Earlier, gold was moving on just one or two fundamental factors, of which geopolitical tension was the primary driver. Now, investors have many options, including the economy, bonds, currency, decisions of the US Federal Reserves, other risk assets, etc. Therefore, it is unfair to say escalating geopolitical tension will drive gold prices,” said Naveen Mathur, associate director (commodities and currencies), Angel Broking.

Considering the current gold and silver prices, analysts anticipate a correction in gold prices. As of August 8, the ratio of the gold price to that of silver stood at 65.89, against 62.36 on July 22.

Gnanasekar Thiagarajan, director, Commtrendz Research, said, “Manufacturing demand for silver has been lacklustre for the several years, owing to weak industrial sentiment globally. Therefore, the presumption that there will be a steep price rise in silver in case there is a bullish sentiment in bullion holds no ground. Consequently, based on current fundamentals, the gold price is likely to decline and bring down the ratio to a comfortable 50.”

On Friday, silver was quoted at $19.90 an oz in the global market, compared with $20.95 an oz about a fortnight ago.

The volatility in bullion prices has increased hedging on the Multi Commodity Exchange (MCX). Gold’s contribute to MCX’s overall turnover increased from 21.4 per cent in April to 23.37 per cent in July and 22.11 per cent till August 8. In absolute terms, the daily average turnover from gold has risen to Rs 4,521.16 crore in August from Rs 3,845.56 crore in April and Rs 4,502.66 crore in July.

The price decline in the domestic market can partly be attributed to a marginal appreciation in the rupee, which closed at 61.15/dollar on Friday, against 61.23/dollar on Thursday.

Haresh Soni, chairman, All India Gems & Jewellery Trade Federation, said, “Physical traders largely remained absent due to a lean season. No fresh buying is happening. There is a good influx of customers, with exchange of old ornaments with new ones.”

Customers continued to defer their buying decisions amid expectations of a cut in import duty, as demanded by a number of traders. Customers feel an import duty cut might be announced soon, and this will bring reduce prices. Hence, fresh buyers still remained absent from the physical market.

)

)