Pulses' import set for new high on less output

With less of sowing and flagging output, besides rising demand, shipments from abroad estimated at 3.7-3.8 million tonnes in 2014-15 and could cross 4 million tonnes next year

Dilip Kumar Jha Mumbai The import of pulses is likely to set a record in 2015-16, due to less of output and rising demand.

Rising local prices have made import viable and these have risen in the current year, too. Prices abroad are Rs 100-150 a quintal cheaper than here. And, the government has allowed duty-free import of chana (chickpea, 80 per cent of total rabi pulses production) till March 31.

Chana farmers have had low prices through two seasons, with trade well below the government's minimum support price.

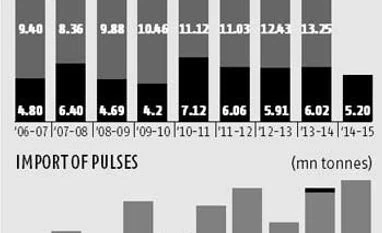

Official figures show the import of all pulses in April-November 2014, the first eight months of the ongoing financial year, was 3.03 million tonnes, a rise of nearly 25 per cent from the 2.42 mt in the corresponding period of 2013. In November, import surged almost 60 per cent to 664,853 tonnes as against 416,038 tonnes in the same month last year. The Directorate General of Commercial Intelligence and Statistics estimates a 20 per cent rise in import of chickpea during April–November 2014, at 222,238 tonnes.

“Pulses import is set to rise steadily to 3.7-3.8 mt this financial year and further to over four mt during 2015-16, on lower output from domestic sources,” said Bimal Kothari, vice-president of Indian Pulses and Grain Merchants Association and managing director of Pancham International, an importer based in this city.

Data from the Union ministry of agriculture showed a decline of a little over 10 per cent in sowing at 14.59 million hectares till last Friday, as against 16.22 mt by the same time last year. The area sown with gram under sowing of gram (chickpea) was 8.59 mn ha versus 10.23 mn ha in the earlier period. Kothari said prices would rise after April, when the final rabi harvest output would be known. Prices are already 10-15 per cent up since the beginning of January.

“Chana is expected to trade mixed to higher in the coming days due to low supplies in the pot market and the new crop to hit the local market in less than a month. The overall sentiment looks positive for chana, amid expected lower output and duty-free export allowed till March,” said Anuj Gupta, an analyst with Angel Commodities.

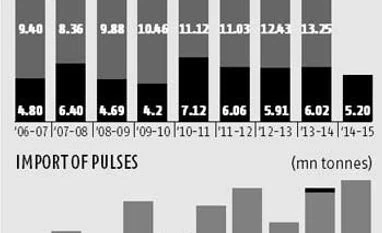

The first advance estimates have forecast a 14 per cent decline in kharif pulses’ production at 5.20 mt as against 6.02 mt last year. The estimated 10 per cent decline in rabi sowing is set to lower production proportionately or even more. Against 23 mt of annual consumption, our production was 19.27 mt in 2013-14. A 20 per cent fall in output is expected for chana.

“As gram's weight is high among pulses, there can be an inflationary pull. Mustard will also exert an upward pressure on prices of oilseeds. However, wheat will still be under control,” said Madan Sabnavis, chief economist, CARE Ratings.

)

)