QIP funding touches 9-quarter low in March

During the previous corresponding quarter, 13 companies had raised Rs 4,857 crore though QIP route

Deepak KorgaonkarPuneet Wadhwa Mumbai / New Delhi A poor start to the equity markets in calendar year 2016 has not only dampened investor sentiment, but also kept companies away from raising funds via the qualified institutional placement (QIP) route.

QIP is a process by which listed companies can raise funds through the issue of securities to qualified institutional buyers.

Read more from our special coverage on "QIP"

Suprajit Engineering is the only company that has raised Rs 150 crore through QIP in the first quarter (January-March) of 2016 — the lowest since the December 2013 quarter when a single company used the QIP route to raise Rs 67 crore. This means funding through QIP in March has hit a nine-quarter low.

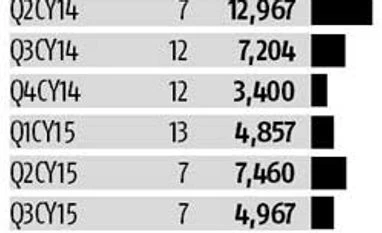

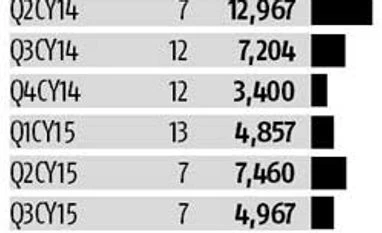

During the previous corresponding quarter, 13 companies had raised Rs 4,857 crore though QIP route, while five firms mobilised Rs 1,780 crore in the October-December 2015 quarter. As many as 32 firms had raised Rs 19,065 crore in 2015 and 33 companies raised Rs 31,685 crore in 2014, according to data from Prime Database.

Analysts attribute the lack of fund-raising to volatile market conditions in the first two months of 2016. “The markets were volatile in the first two months of 2016. Barring the last one month (March), the markets reacted to the developments at the global level thus far in the new calendar year. The conditions have not been conducive for investors to take a decisive view — both from an issuance and investment perspectives,” said Dhananjay Sinha, head of institutional research at Emkay Global Financial Services.

Weak global sentiments cast their shadows on the Indian markets as well, with the S&P BSE Sensex slipping nearly 12 per cent in the first two months. March, however, saw the markets recover 10 per cent on the back of foreign institutional investor (FIIs) inflows after the Budget that stuck to its earlier fiscal (budget) deficit target and raised hope of a rate cut by the Reserve Bank of India.

Despite the weak start and choppy markets, analysts expect the QIP issuance to gain momentum in 2016.

“In terms of process, it takes two-three months for the companies to tap the markets for funds. The market crash in January and February had put off a lot of investors, including those who wanted to raise funds. While the markets crashed 10 per cent, some individual stocks corrected 50 per cent as well. However, I expect this to improve in the second quarter (of 2016) on the back of a market recovery in March,” says G Chokkalingam, founder and managing director, Equinomics Research & Advisory. For companies to raise money via the QIP route, a lot will depend on the overall sentiment in the secondary market, where investors purchase securities from other investors, rather than from issuing companies themselves. A buoyant sentiment in the longer run will augur well, they say. In the immediate term, the road ahead will depend on how the earnings pan out.

“The Nifty may be range-bound between 7,300 and 7,500, assuming a 10 per cent uptick in earnings growth, but the overall sentiment will remain volatile. As a result, the markets will continue to pose a challenge for those who want to come out with fresh issuance even through the QIP route,” says Sinha of Emkay.

Chokkalingam, however, does not see any negative stress points for the markets in the immediate term, given the positive forecast for the monsoon and good inflow of funds in March. “Although I am bullish on the markets from a short-term perspective and believe that there can still be a five-10 per cent upside, one needs to watch the global developments in case the investment horizon is six-12 months. I don’t think the March quarter corporate results will give a big surprise to the markets,” adds Chokkalingam.

)

)