Rio Tinto will close India Bunder diamond project to cut costs

Bloomberg More than a decade after its discovery, Rio Tinto Group said on Monday that it will shut the Bunder diamond mine in India by the end of the year, as the world's second-biggest miner seeks to cut costs and conserve cash.

Bunder remains a top-class diamond deposit and Rio Tinto will work with the federal and Madhya Pradesh state governments to examine options for another investor to take over the project, the company said.

Development of the mine about 500 kilometers (310 miles) southeast of New Delhi has been stymied by delays in environmental approvals that would allow the clearing of a forested area important to tiger and other wildlife habitats. The deposit was discovered in 2004.

Rio Tinto joins other foreign investors such as South Korea's biggest steelmaker Posco who have put Indian plans on hold because of drawn-out approval processes, government red tape and land acquisition hurdles. India is seeking to overhaul exploration and mining rules by cutting the time needed for environmental and state approvals and thereby boost investments.

The Rio project had been in the works for some years and it was time for them to take this move "because these companies need a single window clearance or at least something that works for them," Gunjan Aggarwal, an analyst at consultancy CRU Group, said.

"We still have to reach a stage where these companies, the BHPs, Vales and Rio Tintos of the world feel comfortable investing into mining in India."

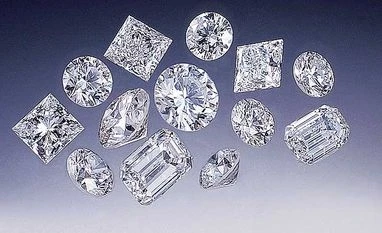

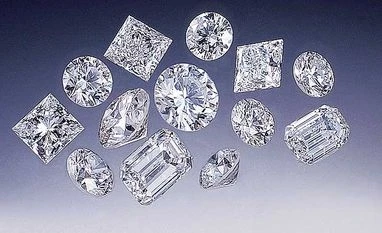

Koh-i-Noor

Indian cutters polish 14 of every 15 of the world's rough diamonds and the country has yielded gems such as the Koh-i-Noor diamond now prized among Britain's crown jewels. The Rio project could have seen the restoration of the nation as a major producer of diamonds.

Rio Tinto had hoped to bring Bunder into production as early as 2019 and the project was pegged as one of only four new mines to enter production in the next decade. Former Chief Executive Officer Sam Walsh pressed Indian Prime Minister Narendra Modi last year for the necessary approvals to develop it.

Rio's exit leaves it with working two diamond projects -- the Argyle mine in Western Australia and the Diavik mine in Canada's Northwest Territories. Walsh was replaced as CEO by Jean-Sebastien Jacques in July.

The miner is also setting up a $2 billion iron ore project in the eastern state of Odisha and holds 51 per cent of the venture, which is forecast to yield as much as 20 million tonnes a year when it starts. Last year, Posco put on hold plans to build a steel plant in Odisha after land acquisition and farmer protests had stalled the $12 billion project for a decade.

)

)