Tech, financial arms help M&M shine

Value of Tech Mahindra and M&M Financial Services in sum-of-the-parts valuations has multiplied substantially in recent years

Sheetal Agarwal Mumbai Mahindra and Mahindra (M&M) has come a long way, from a purely automobile company to a diversified conglomerate, in recent years, with two of its non-auto businesses having achieved significant scale and profitability.

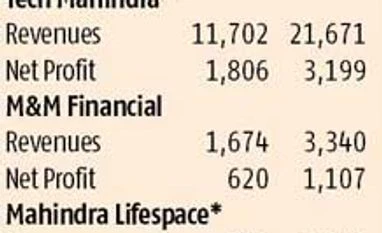

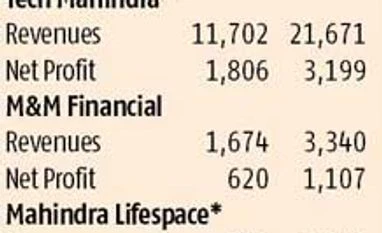

These are Tech Mahindra (TechM, where M&M owns 36.3 per cent stake) and M&M Financial Services (MMFS, owns 51.2 per cent). TechM’s contribution in a sum-of-the-parts (SOTP) valuation of M&M has multiplied three times to Rs 191 a share for FY15 as against Rs 63 for FY12. And, MMFS’ has grown 2.2 times to Rs 113 a share from Rs 52 during this period, as estimated by Motilal Oswal Securities. The standalone automobile and farm equipment businesses are also doing well but these other businesses are growing faster. Today, the duo are responsible for the increase in contribution of non-auto businesses to 28 per cent of M&M’s FY15 estimated target price of Rs 1,145 versus around 19 per cent in FY12.

While the Satyam Computer acquisition elevated TechM to the top fifth listed Indian information technology (IT) services company, diversifying into non-M&M automobile lending and product diversification has enabled MMFS to become a significant non-bank finance company (NBFC) entity. Most analysts remain bullish on these two companies, though the MMFS scrip seems fairly valued for now. The contribution of non-auto would have been higher but for some businesses not doing as well. Given the prospects of M&M’s businesses, the non-auto segment might see its share inch up gradually. Queries emailed to M&M remained unanswered at the time of filing this story.

Tech Mahindra

TechM’s re-rating is largely driven by acquisition, successful turnaround and merger of a much larger company, the erstwhile Satyam Computer. The merger enabled TechM to become a diversified entity and reduce dependence on one client/ business segment. Its largest client, BT, now forms about 12 per cent of revenue as against 65 per cent in 2009. Despite client-specific issues there, TechM has grown its telecom business well. Analysts expect it to post revenue and net profit growth of 17 per cent and 15 per cent, respectively, in FY15, a bit better than industry growth.

With most analysts bullish on the stock and an average target price at Rs 2,118, the potential upside is 17 per cent. Analysts expect the stock’s (trading at 11 times FY15 estimated earnings) re-rating to continue, led by above-industry growth and margin expansion.

“TechM is our top pick in the IT space. Over FY14-16, earnings growth is likely to be ahead of its peers due to strong growth in the enterprise segment (53 per cent of revenues), improving traction in Europe and continued momentum in telecom on the back of improving market share and entry into new segments,” says Pratish Krishnan, IT analyst at Antique Stock Broking. The stock has the potential to re-rate to 13 times one-year forward estimated earnings, he adds.

TechM plans to ramp up revenues from the BFSI (banking, financial services and insurance) and manufacturing divisions, complementing the strong traction in the telecom vertical. The company is also scouting for attractive acquisition targets, to boost growth.

MMFS

MMFS, now lending in rural/semi-urban areas, has expanded beyond automobile lending (small & medium enterprise financing, housing loans, personal loans, insurance broking) to become a significant lender in the retail NBFC segment. A large part of its growth since FY09 has come by lending to the non-M&M automobile segment (M&M’s exposure was down to 46 per cent in December 2013 from 63 per cent in FY09).

While M&M will continue to be a significant part of its auto portfolio, MMFS’ focus is on driving growth across clients, products and segments. Growth in its assets under management (AUM) moderated from 51 per cent in FY11 to 40.6 per cent in FY13, and is likely to further do so to 24.8 per cent in FY14 and 15-16 per cent each in FY15 and FY16. However, this is partly a function of a high base effect and the growth still appears decent, given the macro economic pressures. Though MMFS has witnessed some pressure on its asset quality, the net non-performing assets (NPA) ratio is likely to remain manageable, at 1.7 to two per cent over the next two to three years, estimate analysts.

“We think problems in the agriculture sector are likely to accentuate in the near term, given recent crop failures in Maharashtra and Madhya Pradesh. Hence, high NPL (non-performing loan) levels could be sustained for some time. However, we believe the probability of a favourable election outcome could lead the market to look beyond near-term issues in the sector and continue to give value to an otherwise-strong franchise,” says Saurabh Kumar of JP Morgan.

Of 14 analysts polled by Bloomberg since last month, six have a ‘Hold’ and four each a ‘Buy’ and ‘Sell’ rating. Their average target price of Rs 255 is closer to its current price. Though most brokerages are positive on the company’s long-term prospects, the valuations seem to capture the near-term positives.

Other businesses

Over recent years, M&M has forayed into varied sectors such as real estate development (Mahindra Lifespace), electric cars (Reva), Holiday resorts (Mahindra Holidays), defence and solar power, among others. Mahindra Lifespace is well diversified geographically and caters to the premium and mid-market segments in housing and plans to enter into affordable housing. Most analysts are positive on the company, given its strong execution and launch pipeline (6.1 million sq ft in the next two to three years).

Membership addition (68 per cent of revenue) has been under pressure for Mahindra Holidays. Higher competition from Sterling Holidays and Magic Holidays has added to the pressure. Thus, most analysts remain cautious.

While M&M has forayed into a promising segment of electric cars, growth to an extent is dependent on government push via favourable policies and scaling up of infrastructure (charging points) for this segment. Yaresh Kothari, Angel Broking’s automobile analyst, says, “Reva sales have not picked up yet and we do not expect this trend to change over two to three years. Auto and tractor sales would continue to grow at a healthy pace.”

M&M has also tied up with global players to ramp up its defence business and the opportunity appears significant.

)

)