Turnover on exchanges dips to pre-Modi levels

Ashley Coutinho Mumbai In another sign of the Narendra Modi euphoria losing its grip over the Indian equity markets, the turnover on the stock exchanges has dipped in the past few months to pre-May 2014 levels, signalling declining interest from market participants.

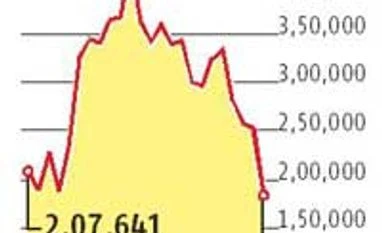

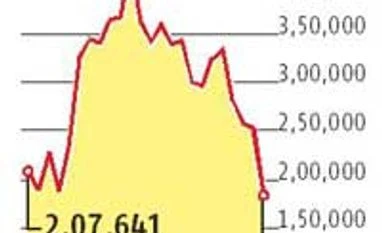

The daily average turnover (both cash and derivatives) on the equities segment of the exchanges between June 2014 and August 2015 stood at roughly Rs 3.4 lakh crore, data collated from the exchanges show. This figure has slipped to below Rs 3 lakh crore between September and November this year. In December, the daily average turnover has further fallen to about Rs 1.8 lakh crore.

"Trading activity as well as participation from retail investors and high networth individuals has come down drastically since March this year as markets have corrected," said Prasanth Prabhakaran, head, retail broking, IIFL.

"Retail investors, in particular, are bulls by nature and their participation comes down drastically when the market tanks or is range-bound," he added.

The Modi government had come to power in May 2014, resulting in renewed interest in Indian equities from institutional as well as non-institutional participants. One year later, the benchmark indices rallied about 12 per cent. However, since March this year, the market has steadily tanked, with year-to-date losses of about seven per cent.

The quantum of trading among foreign institutional investors (FIIs), the biggest drivers of Indian equities, has also declined, said experts. "The interest in India is reducing and the euphoria surrounding the turnaround in the economy immediately after the Modi government came to power has waned a bit," said U R Bhat, managing director, Dalton Capital Advisors (India).

The global risk-off sentiment has spurred foreign investors to pull out money from the Indian market. In December, they have sold shares worth more than Rs 3,300 crore, paring year-to-date purchases to about Rs 14,800 crore. In August, foreign investors had pulled out a record Rs 17,200 crore from the Indian market, while in September they took out Rs 5,695 crore. The Sensex had slid 5.9 per cent in the three months to September, its steepest quarterly loss since 2011.

"In general, emerging markets are not doing that well, and the feeling among overseas investors is that we can look at India later when reforms start to show results," said Bhat.

According to experts, a reduction in FII activity can have a cascading effect on the rest of the market participants. A broker who did not want to be identified said when FIIs trade, stock prices move with big volumes, resulting in technical indicators getting triggered. "This, in turn, creates more volumes," he said.

Experts say the Modi government has not succeeded in initiating key reforms, especially with regard to land laws and state laws on taxation referred to as the goods and services tax.

)

)