Why consumption stocks don't matter for Sensex earnings

As consumption stocks account for 17% of weight in the BSE 500 basket

Hamsini Karthik Mumbai There’s enough cry about how the December quarter results could be a wash-out season for India Inc, with consumption-led stocks bearing a bigger chunk of the pain. But, amid all these cautious statements, if one is to sieve through the performance of certain consumption-oriented sectors, analysis suggests earnings report card of these industries is way insignificant compared to some of the top BSE Sensex companies. So, even as their earnings could be impacted in the December quarter, the same is unlikely to reflect on Sensex earnings.

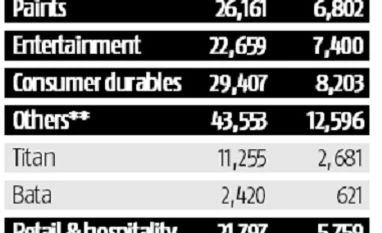

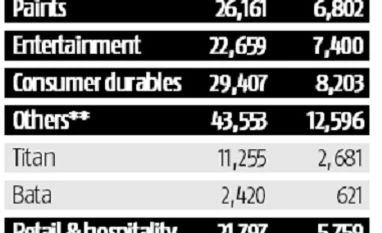

Tata Consultancy Services (TCS) and Reliance Industries (RIL) together accounted for 17.8 per cent of total Sensex earnings on a four-quarter trailing basis. If the combined earnings of all the consumer-led sectors such as fast-moving consumer goods (FMCG), paints, entertainment, consumer durables, jewellery, alcohol, textiles, retail and hotels are added, they still account for only 82 per cent of the combined net profit of TCS and RIL. Their combined revenue is also only 75 per cent of the combined revenues of RIL and TCS. A majority of companies in these consumption sectors are not part of the Sensex but the data gives an understanding of how small they for making a difference. Even for some of them which are a part of the popular index, their influence on Sensex earnings is not much. For instance, the combined earnings of ITC, Hindustan Unilever and Asian Paints (largely seen as consumption bell-wethers and part of the Sensex) on a four-quarter trailing basis adds to Rs 21,709 crore or a little over a fifth of the combined earnings of TCS and RIL, which are largely global plays.

The automobile sector, for now, is the only saving grace in the consumption theme, with a combined four quarters revenues and net profit of Rs 4,38,644 crore and Rs 1,10,274 crore, respectively, surpassing the combined performance of RIL and TCS. Key auto companies that are a part of Sensex are Maruti, Tata Motors, Hero MotoCorp, Bajaj Auto and M&M. However, it’s Tata Motors saving the show in the auto pack thanks to the significant contribution (70 per cent) of its global business, Jaguar Land Rover to revenues and profits. Banking is an indirect play or proxy to consumption and its earnings could weigh on the Sensex earnings in December quarter. Experts say, for the domestic consumption theme to make a mark, it is necessary that their earnings improve substantially, which in turn will help increase their influence on the larger indices like Sensex.

)

)