Last Friday, global markets had one of their worst sessions in the past two years. The US markets were down, with the Dow Jones Industrial Average losing about two per cent. The European markets were down with the major indices losing over one per cent. All major emerging markets (EMs) were substantially down.

Sentiment on EMs has turned sour with China's gross domestic product growth rate expected to drop to a 25-year low. Tepid performances are projected from other EMs. A Reuters poll of 225 economists said growth estimates have either been downgraded, or left unchanged, for nine out of 13 Asian economies (ex-Japan) after October-December 2013 numbers were released. West Asia continues to be in turmoil; Thailand is in shut-down, Turkey is politically unstable, Bangladesh is a mess; India and Indonesia are gearing up for elections.

In the middle of this, the Reserve Bank of India will release its monetary policy review on Tuesday. That's two days ahead of the January settlement, so traders are guaranteed excitement. Another Reuters poll of 50 economists showed that 45 expected the central bank to leave rates unchanged. That's an unusual consensus.

Raghuram Rajan surprised in December by doing nothing. He will surprise again if he does something now. Which direction could he go? Retail and wholesale inflation reduced in December, compared to November. But "core" retail - consumer price index stripped of food and fuel - is marginally up. Core wholesale price index is flat. The Index of Industrial Production is weak. The HSBC Purchase Managers Index implies deceleration for services and manufacturing.

It is possible to make a case for hiking rates. Inflation remains high in absolute terms and it's not expected to reduce much in the medium term. Rajan's recent remarks do suggest he is somewhat hawkish on this subject. But it is also possible to make a good case for cutting rates.

The foreign institutional investors (FIIs) seem to think that rates will not rise. They have been net buyers of rupee equity in moderate quantities in January and they have bought quite heavily into rupee debt. Presumably, they don't expect treasury yields to rise. Or, they see the possibility of the rupee strengthening, or both.

Incidentally, the net institutional stance on Indian equity has been negative in January due to heavy selling by domestic institutions. Retail has been positive enough to keep prices up until Friday. One indicator that retail sentiment may have changed is heavy selling in small caps and mid-caps on January 24. The mid-cap index fell over two per cent - quite a lot more than the Nifty.

The year started well for the rupee with the currency trading strong within a narrow range. However, currency risk may be rising again, given forex outflows over the past fortnight. The dollar has trended up above 62.6 and, if the credit policy makes FIIs unhappy, selling could put the rupee under further pressure. If gold import restrictions are relaxed, that could be another stress point. The current account deficit will remain extremely high in 2013-14, despite a reduction.

On another front, RBI trying to pull old notes out of circulation could have some fallout. Some old notes may come out of trunks and flow into real estate, or gold, prior to the cut-off of April 1. This could provide some temporary stimulus to the economy.

Political parties will also have to cook their books and exchange old notes before going into full campaign mode for the general elections. The Securities and Exchange Board of India has also just tightened P-note norms, so round-tripping off-the-book contributions could be a trifle more difficult. It will be entertaining and enlightening watching politicians putting their war chests together and side-stepping restrictions.

Corporate Q3 results were on the good side of expectations. Apart from the information and technology industry nobody has put up a stellar performance. Biggies such as RIL, L&T, HDFC and Axis Bank have delivered results that either met, or beat expectations, by just a little. The banking system, especially public sector undertaking (PSU) banks, will continue to remain under stress.

PSUs in general, are not seeing much improvement in valuations, derailing the disinvestment programme. The desperate attempts to find alternate means to reduce the fiscal deficit have meant a bonanza for minority shareholders in Coal India. Anecdotally, the Government of India's cash crunch has also meant that tax refunds are being delayed and the income tax and central excise departments are "aggressively pursuing" cases.

Meanwhile, Ranbaxy is in trouble once again, with the American Food & Drug Administration. In Gujarat, the Adani Group, which is very close to Narendra Modi, has appealed against the closure of 12 units in the Mundra Special Economic Zone for lack of environmental clearances. Naturally, there has been the odd conspiracy theory floated about this case.

That brings us back to politics again. No investor is likely to make big decisions and commitments until the shape of the next government is known. The latest opinion polls suggest that the corporate favourite, the National Democratic Alliance (NDA), will indeed be the largest combination, as expected. If that holds true, investors will be happy and the stock market would soar.

But the Aam Aadmi Party (AAP) has thrown a spanner into the psephological models since it could be an "influencer", or key player, in post-poll horse-trading. The unabashedly populist measures taken by the AAP government in Delhi, such as rescinding permission for foreign direct investment in retail in Delhi, cuts in power and water tariffs, etc, have had a terrifying impact. Any government that does not contain the Bharatiya Janata Party will have a bearish impact.

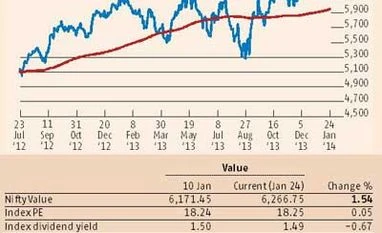

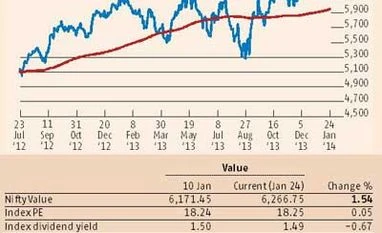

Technically speaking, the market remains stuck within a narrow range although there are signs of sentiment breaking down. The RBI policy review could be a trigger for either a breakout or a breakdown. If the central bank does nothing, the market will probably drift down anyway.

)

)