I-Pru Life gains can boost ICICI Bank's financials

Listing boost from subsidiary could result in 10-20% re-rating of the bank's stock

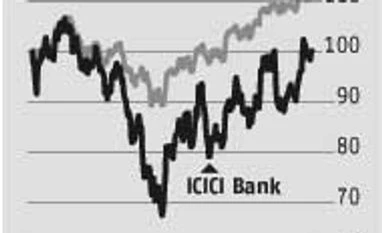

Hamsini Karthik ICICI Bank’s stock has gained over six per cent this month, outperforming the BSE Sensex. But the Street is expecting more gains. In fact, apart from the valuation boost, there are real gains from the financials perspective for ICICI Bank following the listing of its subsidiary, ICICI Prudential Life. Given ICICI Bank’s track record of utilising its one-off gains from the sale of non-core assets towards creating a buffer for bad loans or improving its capital adequacy, analysts expect a similar move from the bank in the September 2016 quarter as well.

Parag Jariwala, vice-president, institutional research, Religare Capital Markets, estimates ICICI Bank will gain Rs 4,900 crore from the I-Pru Life IPO. “The bank is likely to utilise the gain to clean up its balance sheet further,” he points out. “This can be done through higher sell-down to asset reconstruction companies or classifying higher proportion from their below-investment grade assets as non-performing assets and utilise one-time gain for provision or by creating a high amount of counter-cyclical buffer,” he explains. The bank’s counter-cyclical buffer (over and above normal provisions for bad loans) now stands at Rs 2,500 crore and if gains from I-Pru Life’s IPO are added, the buffer could add up to Rs 7,400 crore (around a fifth of loans under the watch list). If any of the three measures or their combination is implemented, it will provide comfort to investors. Analysts expect an incremental 5-10 per cent re-rating in ICICI Bank’s stock should these measures lift the bank’s profitability.

The additional gain is that until the details were announced recently, the Street was expecting the bank to raise Rs 4,500- 5,000 crore through I-Pru’s IPO. But, the same now stands between Rs 5,440 crore and Rs 6,057 crore. Also, they see listing gains following the increase in valuations of life insurance businesses of other players in recent days. In a report dated September 15, analysts at IIFL revised their 12-month target price for HDFC Limited by 13 per cent to Rs 1,570 (upside of 12 per cent), factoring in significant boost to valuation of HDFC Life. Put together, analysts believe there is more upside left for ICICI Bank’s stock.

For ICICI Bank, experts like Rahul Shah, vice-president-Equity Advisory Group, Motilal Oswal Securities, estimate another 10–15 per cent run-up in its stock after the listing of I-Pru Life.

)

)