The other two components that helped reduce the Centre’s debt between 2000-2018 are inflation at about 35 per cent and growth at about 31 per cent. Since India adopted flexible inflation targeting (FIT) de-facto in 2014, the impact of inflation on the debt-GDP ratio is expected to be low in the years following FIT. Indeed, we find that the contribution of inflation falls from 15.6 per cent between 2009-2014 to 6.6 per cent between 2014-2018 on the marketable portion of the Centre’s debt. The primary deficit’s contribution to changes in the debt-GDP ratio falls markedly between 2014-2018 (2 per cent compared to 10.5 per cent between 2009-2014), with the renewed focus after 2014 on meeting FRBM (the Fiscal Responsibility and Budgetary Management Act) guidelines.

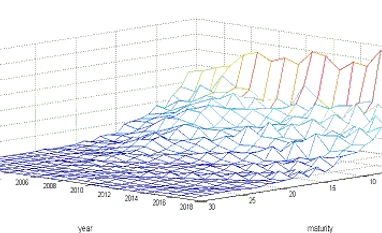

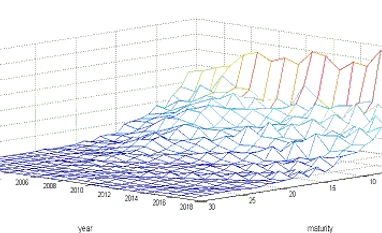

How did the maturity structure affect the Centre plus State (general) debt dynamics between 2005-2018? The table below shows the debt-decomposition results for combined Centre and State securities between 2005-2018 (the security level data for States in our sample starts from 2004). During this period, debt-GDP ratio increased by about 7 per cent and of this 7 per cent, the highest contributing factor was, once again, the nominal returns on the marketable portion of the debt at about 40 per cent. Even the nominal return on the non-marketable portion of the debt was substantial (at about 25 per cent). This is not implausible as during this period, the Centre began to reduce its support in the form of loans to States thereby inducing the States to start borrowing from the market in the form of State Development Loans (SDLs).

During the high inflation years of 2009-2014, the debt-GDP ratio fell by 0.6 per cent. Inflation in this period led to negative real interest rates (-8 per cent) for all three maturity buckets, with the real rates on the 1 year, 2-10 years, and 10+ years being -1.9 per cent, -4.5 per cent, -1.6 per cent, respectively. High inflation during 2009-2014 therefore reduced debt directly, but also via lower negative real interest rates.

In the post 2014 period, with the advent of inflation targeting, growth was high. Despite the helpful contribution from growth in reducing debt, the contribution from the primary deficit (about 8 per cent) and nominal returns (about 22 per cent for all maturity buckets) dominated and this led to an eventual rise in the debt-GDP ratio of about 8 per cent.

)

)