September surprise: Nifty returns 13.6% in dollar terms

Indian equities best among BRICS; good times may last till Dec, say analysts

Malini Bhupta Mumbai Emerging markets such as India are back in focus after being hammered by foreign investors for more than three months, following the Federal Open Market Committee's announcement on May 22 to taper its fiscal stimulus programme. Indian equities have had an unbelievably good run in September, like many other emerging markets. Foreign investors invested $2 billion in September, after selling $4 billion worth of equities. After three months of heavy selling, foreign institutional investors (FIIs) are back to buying emerging markets' assets.

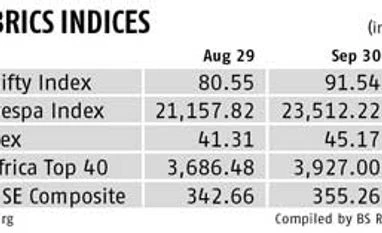

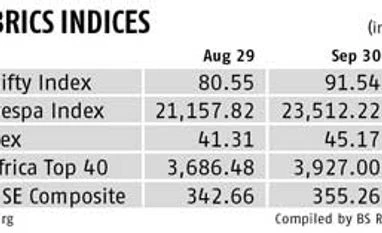

Foreign investors heavily sold bonds and equities of emerging markets such as India, Indonesia, Brazil and South Africa, as yields of US Treasuries moved up sharply on hopes of a US recovery. However, come September and the surprising deferment of the famed taper of the third edition of the quantitative easing (QE) programme, India has suddenly become among the best performing markets in both local currency and dollar terms. In local currency terms, the Nifty has returned six per cent but in dollar terms, the benchmark has returned 13.6 per cent, the best among all other BRICS (Brazil, Russia, India, China and South Africa) countries.

With the currency risk abating, foreign investors have started investing in Indian assets again. Although South Korea and Taiwan witnessed higher FII flows in September, India continued to be the biggest recipient of FII flows on a year-to-date basis with inflows touching $13.4 billion. The rupee's appreciation in September has also helped improve the dollar returns from Indian equities, which had fallen sharply after the rupee fell to 69 against the dollar in August. Analysts believe with the rupee showing signs of stabilising within a tight range of 61-63 against the dollar, investor sentiment should return. Indian equities fared better than China, MSCI Asia, South Korea and Taiwan in September. Deutsche Bank has a December 2013 Sensex target of 21,000, based on the positive developments in September.

Not all the momentum in the markets is to do with sentiment alone or the deferment of the QE taper. Macro-economic data from India, too, has shown improvement over the past couple of months. Though the current account deficit for the first quarter (the quarter ended June) is at 4.9 per cent of the GDP, the trade deficit for August is down to $11 billion against the $17-billion monthly average seen over April to June.

Gold imports, too, are down to 63 tonnes in the second quarter compared with the 343 tonnes in Q1 of FY14. Economists believe improving trade data, coupled with capital flows, will not only help stabilise the currency but also facilitate recouping of dollars by the central bank. However, slower growth will slow down the capital account surplus. In a note, Indranil Sen Gupta of Bank of America Merrill Lynch says: "Although gold import curbs will likely pull down the current account deficit to 3.2 per cent of GDP, poor growth is also likely to shrink the capital account surplus to $70 billion from $89.4 billion in FY13."

)

)