Strong US showing aids Aurobindo's earnings

Market share gains in US & product pipeline will ensure outperformance

Ram Prasad Sahu Mumbai Expectations of a good performance and the Aurobindo Pharma stock’s 28 per cent rise through the last three months weren’t unjustified, with the company posting better-than-expected results for the quarter ended March. Largely led by its performance in the US, Aurobindo posted 48.4 per cent year-on-year growth in consolidated revenue at Rs 2,330 crore; the company’s net profit more-than-tripled to Rs 502 crore. Sale of US formulations rose 129 per cent, owing to strong sales of anti-depressant Cymbalta. Increased sales of high-margin drugs such as Cymbalta helped Aurobindo post its highest ever earnings before interest, tax, depreciation and amortisation margin of 31.9 per cent.

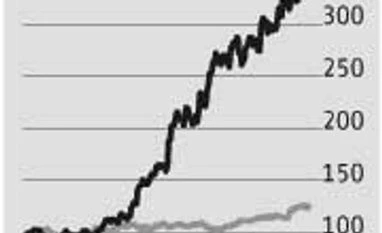

What aided the company’s performance in the US market was gain in market share for key products. Bank of America Merrill Lynch (BoAML) analysts estimate the company’s market share in the US generics market increased from 1.6 per cent in FY11 to four per cent in March 2014. The market share for Cymbalta, a drug with a market size of $5 billion, launched about six months ago, is pegged at about 25 per cent. These gains have helped Aurobindo more-than-triple its US revenue from $56 million in the first quarter of FY12 to $186 million in the March quarter 2014. Analysts expect the company to sustain sales in the US due to its product pipeline of injectables, antibiotics and controlled substances. BoAML analysts believe the pipeline will ensure 20 per cent annual revenue growth during FY14-16, in dollar terms.

How soon the company is able to turnaround the January 2014 acquisition of the Western European assets of Actavis is likely to be another trigger. Given the loss-making acquisition, it is likely to weigh on Aurobindo’s consolidated earnings (impact of one-six per cent), with a turnaround expected in about two years. However, given the strong back-end set up in India and an entry into the hospital segment through this acquisition, analysts say there are significant synergies and a ready distribution platform for Aurobindo’s high-margin injectables portfolio.

As the stock price has risen by a factor of four in the past year, analysts believe some of the upsides are already factored into the stock. Of the 27 analysts tracking the stock, 16 have a ‘buy’ rating, eight hold and the rest have sell. While there will be earnings upgrades, the consensus target price of Rs 617 suggests immediate gains might not be there. On Monday, the stock fell about four per cent in morning trade. Hovering at about Rs 640, it is trading at 13.5 times the FY15 estimated earnings, and can be bought on dips from a long-term perspective.

)

)