Lower your gold holdings

If you are sitting on profits, book these now. Don't try to average out costs

Joydeep GhoshNeha Pandey Deoras Mumbai For aggressive investors in gold, the recent sell-off has a lesson - don't be overexposed to any asset class. But with stock markets going nowhere in the past five years, gold was their only hope for inflation-adjusted returns.

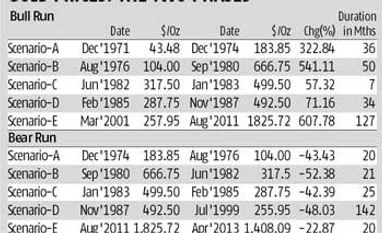

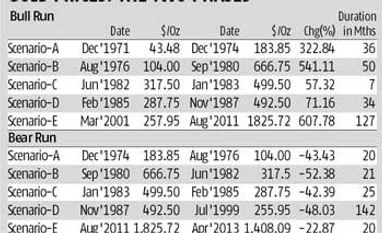

For a decade, there were no complaints as the yellow metal rose a whopping 600 per cent - its best run since 1971. But things are beginning to change, and fast. Just a week back, gold was at Rs 30,000 levels. It has slipped to around Rs 26,500 levels, a correction of over 10 per cent in less than a week. But there is some solace. Historically, gold seldom has had long bull or bear runs. It has done well or badly for three-four years. Besides the decade-long bull run since 2001, it had one long bear run - between 1987 and 1999 when prices fell by almost 50 per cent. It has corrected or risen sharply in shorter periods. For example, it fell 52.4 per cent in just 21 months in the 1980s and rose by 323 per cent in the 1971-74 period.

No wonder, analysts are unwilling to stick their necks out. "On the domestic front, gold should stabilise at the Rs 25,500-26,000 level. But, I won't be surprised if this level also gets breached," says Naveen Mathur, associate director - commodities & currencies at Angel Broking. Most feel the fall might continue for more time.

For investors who have loaded their portfolio with gold, it is time to start booking profits. "If you have invested over the last three years, thinking the metal may give 20-30 per cent returns year-on-year for some more years, you should start looking at lowering your holding. Investing in gold with a five-year horizon can be very risky. Such individuals should not hold more than 5-10 per cent gold," says Raghvendra Nath, managing director of Ladderup Wealth Management.

But don't sell immediately. Wait for a week or 10 days for things to settle. For those who have just started investing in gold, there is no point in selling at a loss. But don't try to average out costs by buying more. "The outlook for gold is tepid over the next two-three years, as the metal is coming off its historic peak. Hence, returns would be limited to seven to eight per cent annually. A fixed deposit can get you similar returns, with capital safety," explains Nath.

Of course, if you are planning to buy gold for consumption - a marriage or any other event - if the fall continues, it could be a good time to buy. Like the father in a jewellery advertisement says, "How will we afford gold after 20 years." Well, the recent fall could be a good opportunity.

)

)