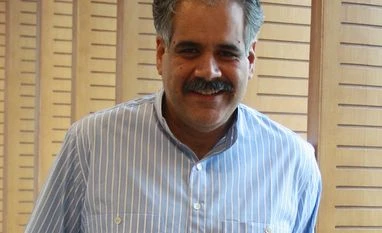

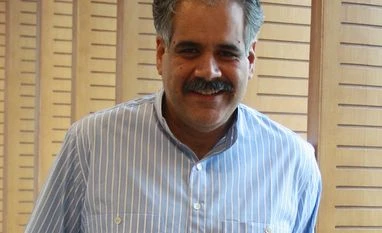

Related party transactions just 0.53% of InterGlobe turnover: Rahul Bhatia

Rahul Bhatia's group Wednesday said that all related party transactions with the company have been executed at arms length basis in ordinary course of business

)

Explore Business Standard

Rahul Bhatia's group Wednesday said that all related party transactions with the company have been executed at arms length basis in ordinary course of business

)

A day after InterGlobe Aviation co-founder Rakesh Gangwal flagged concerns over governance matters, Rahul Bhatia's group Wednesday said that all related party transactions with the company have been executed at arms length basis in ordinary course of business.

Bhatia is also a co-founder of InterGlobe Aviation Ltd (IGAL), the parent of the country's largest airline IndiGo.

In a detailed statement, Bhatia's InterGlobe Enterprises (IGE) said it has nurtured and supported IGAL through its formative and expansion years by making available certain services through related party transactions.

Currently, there are related party transactions in four areas -- real estate leased to IGAL, simulator training facilities, General Sales Agreements (GSAs) for limited foreign markets and crew accommodation at Accor Hotels, the statement said.

Citing unaudited numbers for 2018-19, the statement said the related party transactions in the four areas accounted for Rs 150.12 crore or 0.53 per cent of IGAL's consolidated turnover.

"All related party transactions have been executed on an arms' length basis and in the ordinary course of business. The IGE Group has nurtured and supported IGAL through its formative and expansion years by making available these services," it noted.

Gangwal and his affiliates have around 37 per cent stake in IGAL while Bhatia and his affiliates (IGE Group) have about 38 per cent.

On Tuesday, Gangwal sought markets regulator Sebi's intervention to address the problems.

Sebi has also sought response from IGAL by July 19.

Flagging concerns about certain questionable Related Party Transactions (RPTs), Gangwal had said shareholders' agreement provides his long-time friend Bhatia unusual controlling rights over IndiGo.

"Beyond just questionable Related Party Transactions, various fundamental governance norms and laws are not being adhered to and this is inevitably going to lead to unfortunate outcomes, unless effective measures are taken today," the letter said.

Amid the spat between the promoters, shares of IGAL plunged over 11 per cent on Wednesday wiping out Rs 6,423 crore from its market valuation.

First Published: Jul 10 2019 | 8:00 PM IST