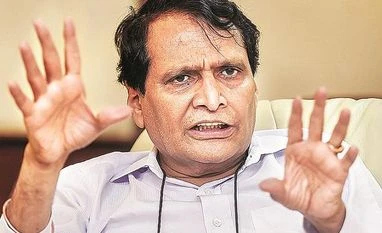

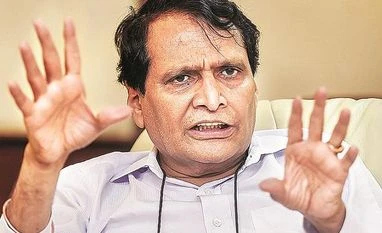

ATF under GST will ensure level playing field for domestic airlines: Prabhu

He said input costs should be competitive for any sector and the ministry has been of the strong view that the fuel should be brought under the GST regime

)

Explore Business Standard

He said input costs should be competitive for any sector and the ministry has been of the strong view that the fuel should be brought under the GST regime

)

Aviation turbine fuel (ATF) should be brought under the Goods and Services Tax (GST) regime as it will ensure a level playing field for the domestic airline industry, Civil Aviation Minister Suresh Prabhu said.

He said input costs should be competitive for any sector and the ministry has been of the strong view that the fuel should be brought under the GST regime.

Different rates of taxes in states pushes the price of ATF, he said.

"Each state has a different tax. Due to this, the refuelling (for airlines) cost completely changes. We feel that it should be done. I hope the GST Council takes a call on that and we are pursuing this with the council continuously.

"We will work on it that aviation fuel should also be brought under GST for predictability and for ensuring level playing field," the minister told PTI in an interview.

Airlines have been demanding inclusion of ATF in the new indirect tax regime.

Airlines could expect an annual relief of up to Rs 5,000 crore by way of input tax credit if ATF is brought under GST.

The move could cushion them from the burden of increased jet fuel prices, besides providing relief to customers.

First Published: Apr 07 2019 | 11:35 AM IST