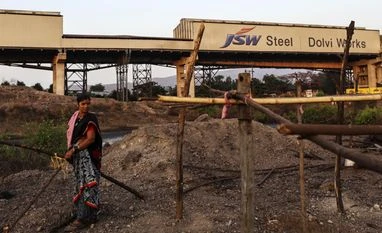

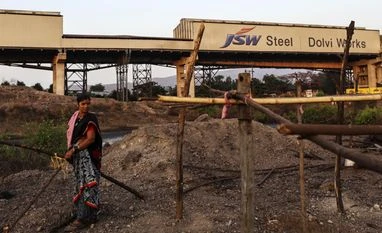

JSW Steel likely facing hurdles in coking coal imports from Mongolia

The company had aimed to import 2,500 metric tons from Mongolia, while the Steel Authority of India was looking to bring in 75,000 metric tons

)

Explore Business Standard

The company had aimed to import 2,500 metric tons from Mongolia, while the Steel Authority of India was looking to bring in 75,000 metric tons

)

JSW Steel, India's largest steelmaker by capacity, has hit a roadblock in sourcing coking coal from Mongolia due to unresponsive suppliers and transport bottlenecks, three sources familiar with the matter said.

The company had aimed to import 2,500 metric tons from Mongolia, while the Steel Authority of India was looking to bring in 75,000 metric tons.

India, the world's second-largest producer of crude steel, meets 85 per cent of its coking coal requirements through imports, with Australia supplying more than half of those shipments. Steel demand has skyrocketed in the country driven by rapid economic growth and increasing infrastructure spending.

In a bid to diversify its supply chain for the key steelmaking ingredient, India has been exploring partnerships with resource-rich Mongolia, which industry officials have identified as a viable source of high-grade coking coal at relatively lower prices.

"There is no response from the Mongolian side, and we are finding it difficult," one of the sources said, declining to be identified due to the sensitive nature of discussions.

"On one hand, transport from Russia is clogged and on the other, it may not be feasible to get it from China on a sustainable basis," the source said.

Steel Secretary Sandeep Poundrik said over the weekend that there were logistical challenges in sourcing material from landlocked Mongolia.

The Mongolian prime minister's office and JSW Steel did not respond to emails from Reuters seeking comment.

Ties have soured between India and China since the 2020 clash between troops along their Himalayan border, which killed at least 20 Indian soldiers and four Chinese.

However, there have been some signs of thaw with the neighbours agreeing in January to work on resolving trade and economic differences.

Separately, JSW Steel, which imports about close to one-third of its coking coal needs from Russia, has no plans to increase imports from Moscow, the source said.

"We don't want to raise our exposure in one geography," they said.

The company also sources coking coal from Australia, the United States and Mozambique.

Chief executive Jayant Acharya told Reuters last week that JSW Steel was open to buying coking coal assets based on commercial and strategic viability.

India's coking coal imports will accelerate due to the limited availability of the key steelmaking ingredient amid a ramp-up of steel capacity, the steel secretary said last week.

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)

First Published: May 01 2025 | 1:18 PM IST