Budget impact: Merger may create 2-3 oil and gas mammoths

If all the companies are joined together, it would create the biggest company in India

)

premium

graph

Last Updated : Feb 03 2017 | 1:16 AM IST

The oil and gas sector would have two or three mega-companies and not one single entity through the merger of 13 oil public sector undertakings, as was announced in the Budget.

Finance Minister Arun Jaitley had on Wednesday said the government was planning to merge all the public sector undertakings in the oil and gas sector to create an integrated company. When asked about this, an official close to the development said, “It may lead to the merger of several mini-ratnas into maharatnas and navratnas to form at least three or four big companies.” The new companies are likely to be integrated oil and gas majors. Industry experts were not too enthusiastic about the Budget announcement to go for a mega-merger and form a single entity.

“It may create cultural issues,” said R S Sharma, former managing director of ONGC. “I am of the opinion that there should be a single holding company rather than a mega-merger. It may give huge revenue to the government in the form of disinvestment and will also lead to cost savings of at least 10-15 per cent through sharing of infrastructure and manpower.”

Companies might get to decide which one would merge with what. “We want to create a synergy so that the international fluctuations in oil prices will not affect our exploration and production companies and marketing companies,” added the official.

If all the companies are joined together, it would create the biggest company in India and the biggest in the sector globally.

The idea was first mooted by former petroleum minister Mani Shankar Aiyar way back in 2005. The list of oil industry maharatnas includes Oil and Natural Gas Corporation (ONGC), Indian Oil Corporation Ltd (IOCL) and Gas Authority of India Ltd (GAIL). According to the proposal, upstream companies like ONGC and Oil India and downstream majors like IOC, HPCL, BPCL and even companies like GAIL India and Engineers India were supposed to merge and become a single entity. The list of oil industry navratnas includes Bharat Petroleum Corporation Ltd (BPCL), Hindustan Petroleum Corporation (HPCL) and Oil India Ltd (OIL).

The task at hand

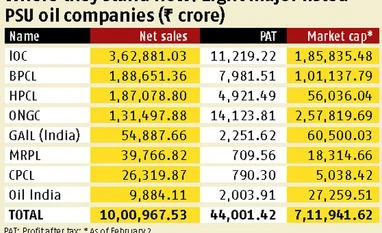

Business Standard looks at the eight major listed public sector oil companies, how they fare in terms of market capitalisation, net profit and revenue earned in FY16. The numbers show the proposed oil mammoth would be able to compete with domestic private companies, but would not be able to match global majors. With a total market capitalisation of about $104 bn, the new oil major would be on a par with BP Plc, which has market capitalisation of $116.72 bn. The top four global listed oil companies by market capitalisation each have a market cap that is two to three times higher than that of the combined might of the eight public sector undertaking oil companies. The proposed oil major will have a long road ahead to turn relevant on the global map. Industry experts say the merger will be a mammoth task in itself and may turn out to be a long-drawn process. Here is a status check: