Constitute expert group to revive ailing HMT Limited: Parl panel to govt

The government had recently decided to close down three subsidiaries of HMT Limited

)

Explore Business Standard

The government had recently decided to close down three subsidiaries of HMT Limited

)

A Parliamentary panel has asked the government to constitute an Expert Group consisting of renowned technocrats to examine the prospects of reviving all the ailing units of HMT Limited.

In its report presented to the Lok Sabha, the Committee on Petitions suggested to the Centre to chalk out a detailed strategy of allocating a 'Special Financial Package' to all PSUs, including all units of HMT, to release the withheld pay and allowances apart from statutory dues to all serving as well as retired employees before March 2019.

The panel said it was "flabbergasted" to discover the huge backlog in payment of salaries and other allowances to the employees of various units of HMT Limited, and that the "statutory dues" of retired employees or those who availed VRS had not been released.

"The Committee, therefore, recommend that the Union Government should now take the initiative of working out a detailed plan of giving a 'Special Financial Package' to all the public sector undertakings, including all the subsidiaries of HMT Limited, to release the withheld pay and allowances along with the statutory dues to all serving/retired employees prior to the end of the current fiscal year," the panel said.

Besides, it recommended that the Centre undertake an original time-bound comprehensive study to assess the overall performance and requirements of public sector undertakings in the country with a view to making them commercially viable, an engine of growth and a major employment generator.

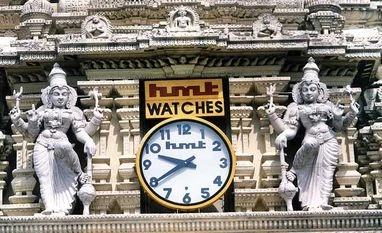

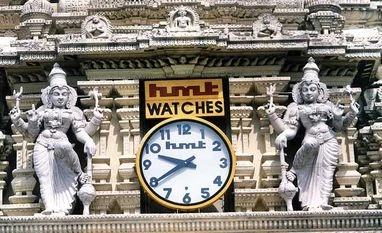

The government had recently decided to close down three subsidiaries of HMT Limited, namely HMT Watches, HMT Chinar Watches and HMT Bearings, by offering voluntary retirement/separation schemes to its employees which is under implementation.

The company's tractor division at Pinjore, Haryana, was provided a revival package in August 2013 but could not turn around owing to various factors like rising costs, technology gap, market conditions and working capital constraints.

It degenerated substantially with mounting losses and pending dues towards salaries, statutory liabilities, outstanding dues of suppliers and service providers as well as complete erosion of working capital.

First Published: Aug 05 2018 | 12:39 PM IST