Heavy CV sales up after 2 years

Expected to continue, with rise in growth sentiment after govt formation and stress on boosting manufacturing, infrastructure

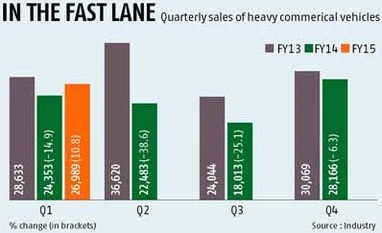

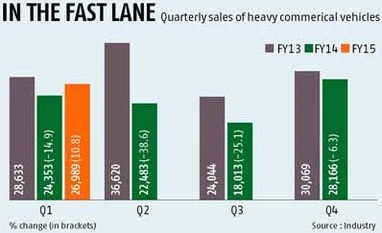

Sharmistha Mukherjee New Delhi Sales of heavy commercial vehicles (HCVs), regarded by many as a barometer of economic activity, rose 11 per cent in the three months ended June 30, for the first time in about two years. Sales were 26,989 units in the quarter, the first of 2014-15, a rise of 10.8 per cent over the 24,353 units sold in the corresponding period of FY14.

Rajan Wadhera, chief executive officer, truck and powertrain division, Mahindra & Mahindra (M&M), said: “Sales of CVs declined more than 50 per cent over the past two years. There are reassuring signs now; economic activity is picking up. There has been a turnaround in sales of HCVs in the first quarter and I expect the momentum to sustain in Q2.”

Data from the Society of Indian Automobile Manufacturers (Siam) show sales of medium and heavy commercial vehicles (MHCVs) dropped 43 per cent to 200,627 units as of March, from 348,701 units in FY12. Further, the share of MHCVs in overall sales of CVs dipped to 31.7 per cent in FY14 from 43 per cent two years earlier. HCVs accounted for 44 per cent of total sales of MHCVs in 2012-13.

“There is a noticeable change in business environment. With big-ticket infrastructure projects lined up for execution, truck owners are coming back to the market to replace older vehicles and getting ready for the boom,” added Wadhera. The sales push is driven by demand in the country’s northern parts, where offtake of HCVs has gone up as much as 40 per cent. The demand is coming both due to implementation of infrastructural projects and increased movement of agri products in north India.

The extension of excise concessions has further helped inspire confidence in truck owners on replacing and expanding their fleet, say industry insiders. Vinod Aggarwal, chief executive officer, VE Commercial Vehicles, said: “There are two reasons for the rise in sales in the HCV segment. First, sales of heavy-duty trucks halved to 10,000 units a month in Jan-March 2014 from 20,000 units two years ago. The industry has bottomed out. Second, with the new government in place, sentiments have improved. The excise concessions have helped.” Sales of HCVs have been led by demand for 40/49 tonne haulag trucks (tractors- trailers) , which currently account for 70 per cent of volumes in the category. These sales have risen 43 per cent over the past six months.

Aggarwal said, “The government has levied a cess on coal to promote domestic production. Further, with mining and construction projects gaining pace, demand for tippers (contributing around 30 per cent to HCV sales) would also go up over the next few months. Last year's GDP growth happened due to growth in agricultural activity. With the focus on manufacturing, industrial activity will pick up, which will push CV sales.”

In fact, freight rates have gone up by around 12-15% in the last six months, according to a report by Indian Foundation of Transport Research & Training (IFTRT). In its June report, IFTRT said, "It is significant that various contractual transport businesses in the infrastructure sector (has seen) the augment of their transportation requirement at project sites, which require 35 ton - 49 ton capacity tractor trailer. Further, it is reiterated that shrinking truck fleet on National Permit routes helped to improve truck rentals, while dispatches from factory output generally remain flat except improvement in despatches of FMCG, consumer durables, general merchandise and housing construction material improved in tier-I and tier-II cities."

)

)