Motown sees record car sales in FY16

New launches, lower cost of ownership fuelled this; FY17 likely to be tougher

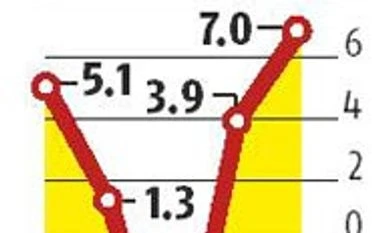

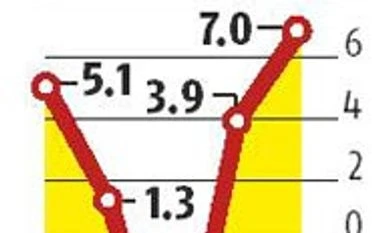

Ajay Modi New Delhi Car sales were on the fast track in the financial year just gone by, with the industry posting highest-ever annual sales of 2.78 million units, a growth of seven per cent compared to the previous year. The growth was largely fuelled by two dozen launches and lower ownership costs, even though the industry faced several challenges. Also, the growth was limited to a few companies.

This is a consecutive year of growth for the industry. The sales of passenger vehicles - cars, vans and utility vehicles - grew 3.9 per cent in FY15 to 2.6 million units.

Read more from our special coverage on "CAR SALES"

However, in the last month of FY16, the industry reported low single-digit growth. While companies such as Maruti Suzuki, M&M and Renault reported healthy volumes, others like Toyota, Honda and Tata Motors posted steep declines, for a variety of reasons.

Experts say the new financial year might be a difficult one for carmakers because of a host of factors. While they increased prices in January, the government imposed an infra cess of one to 2.5 per cent on cars. While the price increase may not be much for entry level cars, those buying expensive cars will have to shell out a lot more. Additionally, fuel prices, which have been benign for many months, seem to be on an uptrend. To add to these factors, there is growing uncertainty, on the fate of diesel vehicles with the Supreme Court banning registration of vehicles with engine capacity of 2,000cc or more in the National Capital Region.

Maruti Suzuki, which is now at a 14-year-high market share of 47 per cent, grew sales by 14.6 per cent in March and closed the year at an all-time high domestic sales of 1,305,351 units.

R S Kalsi, executive director (sales and marketing) at Maruti said contribution from new models like Baleno and Brezza and strong performance of existing models like Ciaz helped growth. "We will enjoy the fruits of new models in FY17, too, when their full year impact will be visible. We will continue to grow at double digit while industry may grow at a single digit."

Korean automaker Hyundai grew at about four per cent in March though its full year domestic sales were at record 484,324 units, up 15 per cent from FY15. Even Hyundai's market share is at a record high of 17 per cent, helped by growth from Creta, a new product, Elitei20 and Grandi10. Rakesh Srivastava, senior vice-president (sales and marketing) at Hyundai said the industry may see growth challenges in the new financial year. "Major roadblocks are now visible".

Utility vehicle major M&M, the third largest player, closed the year with a growth of six per cent after a rough performance in FY15 when its sales had dropped 12 per cent. New launches - TUV300 and KUV100 helped the company. Its March sales grew by 21 per cent. It has overcome challenges created by Supreme Court ban on diesel vehicles of 2,000cc and above by introducing 1,990cc diesel engines on its popular models. Tata Motors has seen sales dip by a steep 44 per cent in March and a decline of six per cent in FY16, as its compact as well as UV segment did not perform.

For Toyota, however, the SC ban in NCR has been a major setback. Its sales have declined constantly as it has been unable to sell two popular models - Innova and Fortuner in the NCR market. Honda, another Japanese company, closed March with a steep decline of 23 per cent while its fiscal sales grew by just 2 per cent. Renault continued its strong performance and posted 160 per cent growth, helped by its affordable hatchback Kwid.

German carmaker Volkwagen too declined by 22 per cent in March. Companies like Nissan and GM are also learnt to have posted decline in sales though these companies have not announced March numbers.

)

)