Two-wheeler sales growth low in FY16

Muted demand from rural markets dents growth

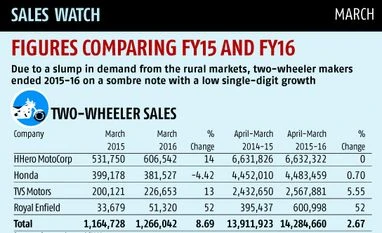

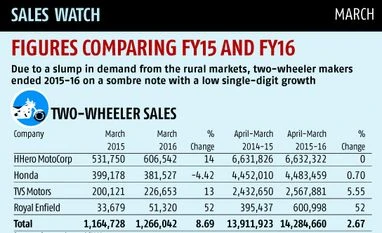

BS Reporter Mumbai Two-wheeler makers ended FY16 on a sombre note with a low single-digit growth following slump in demand from the rural markets, which account for two in every five two-wheelers sold in the country.

The year saw many launches in both the motorcycle and scooter categories from Hero, Honda, Bajaj Auto, TVS Motor, Yamaha, Suzuki and Royal Enfield. However, growth was driven purely by scooters even as motorcycles, especially the budget segment, struggled to gain momentum.

Market leader Hero MotoCorp reported nearly no growth in sales, ending the year at 6,632,322 units, compared to 6,631,826 units sold in 2014-15. Although new models have picked up pace, its scooter range command a share of just 13 per cent in Hero’s total sales. However, its March sales reported 14 per cent growth.

Pawan Munjal, chairman & managing director and chief executive of Hero MotoCorp, said: “In the past five years, we have consolidated our leadership in the face of a volatile market and intense competitive environment, even as Brand Hero has become globally known, with presence in about 30 countries across Asia, Africa, and central and south America.” Last year, erratic and deficient monsoon played spoilsport for the industry. For Hero MotoCorp, around 40 per cent of its volumes come from the rural belts.

“The industry witnessed mixed fortunes in FY16 with sales looking up in the second half of the year. Timely measures by the government and a good monsoon will be essential in sustaining this positive trend. The journey from here promises to be even more exciting as we gear-up to launch our in-house developed products,” said Munjal.

Hero’s arch-rival and the country’s second biggest two-wheeler maker, Honda Motorcycle and Scooter India (HMSI), posted nearly one per cent growth during the year ending at 4,483,459 units as scooter demand remained upbeat.

Sales during 2014-15 stood at 4,452,010 units. “Increased efficiency and flexibility in production translated to a growth of one per cent even as Honda’s all three existing plants in India continued to run on peak capacity,” stated a release from the Delhi-based company.

HMSI is expanding capacity to meet demand through its fourth plant located in Gujarat with a capacity of 1.2 million units a year.

Chennai-based TVS Motor, the third largest two-wheeler seller in India, clocked the best growth among the top four. The company sold 2,567,881 units in FY16, marking a six per cent growth against 2,432,650 units in 2014-15.

Niche bike maker Royal Enfield clocked the highest growth in the financial year gone by at 52 per cent, as demand for its Classic range continued to beat supply. The Chennai-based company clocked 600,998 units in 2015-16 compared to 395,437 units sold a year ago.

Rudratej Singh, president of Royal Enfield, said: “Royal Enfield has been expanding its production commensurately to meet customers’ expectations to own and ride our motorcycles at the earliest. Royal Enfield’s simple yet evocative motorcycles have been aspirational yet accessible, providing a pure motorcycling experience to our customers. This experience has created strong demand for our motorcycles that continue to grow our order books.”

)

)