Timing is not only for stock traders. It is equally important in the highly cyclical and capital-intensive shipping business.

No one know this better than Bharat K Seth, deputy chairman and managing director of Great Eastern Shipping Company, the country’s largest private company in the sector and now the most valuable among its peers. In the past two years, the GE Shipping stock price is up 50 per cent against a 25 per cent drop in the market value of its government-owned rival, Shipping Corporation of India (SCI).

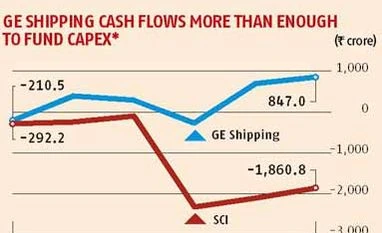

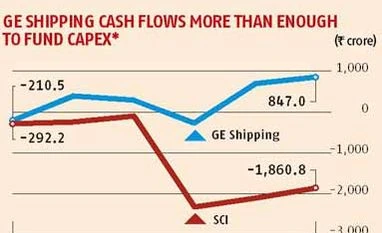

At its current stock price, GE Shipping is now two and half times more valuable than SCI, despite the latter being 40 per cent bigger in terms of revenue. The gap between GE and others in the industry is set to widen, given its superior finances and better growth outlook (see chart).

Timely capex Analysts attribute this to the company’s contra capital expenditure (capex) and ship disposal strategy. “Most of its asset (ships) acquisitions were done pre-2008, which has lowered its capex cost compared to SCI, which delayed its capex plans,” said Bharat Chhoda, assistant vice-president, research, ICICI Securities. Seth did not want to comment, despite repeated calls and emails.

GE Shipping was one of the first in the industry to have cranked up capex in 2004, as the global commodity boom was taking shape and new ships were cheaper and delivery was fast. Beginning 2006, there was a spike in the price of ships, as companies rushed to place orders for new vessels to take advantage of China's voracious appetite for iron ore, coal, oil & gas and other industrial commodities. The company was done with fleet expansion by the middle of 2008, just before the Lehman crisis pushed global trade in bulk cargo — the staple of Indian shipping companies – into a free fall. This helped the company make the most of the boom in global trade, besides locking in assets at lower prices than its peers.

The Baltic Dry Index that tracks the charter rates for bulk carriers peaked on May 20, 2008, at 11,793 points, a six-fold jump in three years. The index was quoting at around 2,000 in the middle of 2005. Over the next six months, the index lost nearly 95 per cent of value, reaching 663 points on December 5, 2008, its lowest since 1986.

In all, GE Shipping acquired ships and vessels worth Rs 4,500 crore between FY04 and FY09, accounting for 70 per cent of all its assets (at historical costs) at the end of March this year. Post FY09, it froze capex and became a net seller of ships: It has disposed ships worth a little over Rs 1,000 crore and made a profit of Rs 700 crore in the process in the past five years.

“GE Shipping timed the disposal of ships in line with the global trade cycle, helping it to lower its capex cost, beside getting rid of excess capacity," says an analyst with a local brokerage, on condition of anonymity.

Low leverage In contrast, SCI has been in capex mode for nearly a decade. In the past 10 years, the company has cumulatively spent Rs 11,500 crore on acquiring new vessels, 55 per of it in the past three years. This has landed it in a financial soup, as capex

has been more than twice its internal cash accrual in the past five years, forcing to borrow to meet the shortfall. In contrast, GE Shipping (on a standalone basis) has generated free cash flows every year since FY08, resulting in a steadier balance sheet.

In the year ended March this year, GE Shipping’s debt to equity ratio (on a consolidated basis) was 1.06, up from 1.02 in FY12. This was lower than SCI’s 1.09 (0.79 in FY12) and Mercator’s 1.37 (1.22 in FY12). If one excluded its offshore subsidiary, Greatship (India), GE Shipping’s leverage ratio would have been even lower, at 0.74 in FY13.

Low leverage and strong cash flows allows GE Shipping to have the best credit rating in the industry, giving it access to low cost funds. GE Shipping’s long term debt carries AAA rating against SCI’s BBB rating and Mercator’s A rating. “High rating has lowered its cost of funds which is a big competitive advantage,” said Siddhartha Khemka, vice president-research, Centrum Wealth Management.

Gains from offshore GE Shipping’s another competitive advantage is its offshore subsidiary, Greatship (India). Charter rates in the offshore segment are far stable and locked-in for the long term, that cushions the earnings volatility in its shipping business. Offshore now accounts for 41 per cent of its consolidated revenue, up from 23 per cent three years earlier. “Offshore provides a steady stream of revenue and is like an assured business during the contracted period,” said an analyst with a local brokerage. In the past five years, Greatship’s revenue had more than quadrupled to cross Rs 1,400 crore in FY13, against a 50 per cent fall in shipping revenue during the period.

SCI, on the other hand, basically remains a cargo mover, with presence in the bulk and container segment. In FY13, the bulk cargo segment (Rs 2,901 crore) accounted for two-third of SCI revenue and container cargo (Rs 1,174 crore) for a quarter. The balance (Rs 233 crore) came from other segments, including offshore and passenger services. The container business is bleeding and reported losses of Rs 312 crore in 2012-13, nearly double the profits in the other two segments, forcing it to declare a net loss for a consecutive year.

)

)