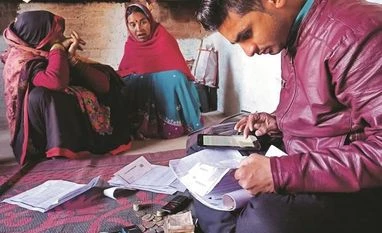

MFIs welcome RBI's regulatory framework for microfinance loans

Microfinance institutions and an MFI-turned lender hailed the RBI's Regulatory Framework on microfinance loans saying that these guidelines will further deepen penetration of micro-credit in country.

Press Trust of India Kolkata Microfinance institutions and an MFI-turned lender hailed the RBI's Regulatory Framework on microfinance loans announced on Monday saying that these guidelines will further deepen the penetration of micro-credit in the country.

The Reserve Bank of India (RBI) allowed microfinance lenders to fix interest rates on loans with a rider that those should not be usurious for the borrowers.

A microfinance loan is defined as a collateral-free loan given to a household having an annual income of up to Rs 3 lakh.

The framework for microfinance loans announced by the RBI will further help deepen penetration of micro-credit in the country, MD & CEO of Bandhan Bank C S Ghosh said.

Bandhan Bank is a microfinance company that got a universal banking licence some years ago.

The latest guidelines are a strong reflection of the maturity of MFIs in the country and will go a long way in harmonising the regulatory framework for different types of lenders, encouraging healthy competition and enabling customers to make an informed choice regarding their credit needs, Ghosh added.

The new framework will help scale the industry further, ensure better risk mitigation and financial inclusion, he said.

MD & CEO of Village Financial Services Kuldip Maity said this is indeed a welcome step and mark the beginning of a new era of the MFI sector.

The common regulatory framework will create a level playing field and both borrowers and lenders will now have options. The new framework will safeguard the interests of the borrowers and help the sector to cater to the needy borrowers, he said.

CEO and Director of MFIN Alok Misra said the framework is comprehensive and it will usher a new beginning in the MFI industry.

He said RBI has taken prudent steps on credit delivery and low-income households will now have access to credit.

Sa-Dhan, an RBI-recognised self-regulatory organisation for microfinance institutions, also welcomed the Master Direction of the RBI on Regulatory Framework for Microfinance Loans.

Its Executive Director P Satish said, "Sa-Dhan is pleased with the newly released Master Direction of the RBI on Regulatory Framework for Microfinance Loans, as this lender agnostic comprehensive regulation will bring uniformity in the sector.

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)

)