Unhedged forex exposure: RBI prescribes stringent provisioning for banks

Also prescribes way in which loss incurred be unhedged foreign currency exposure should be calculated

BS Reporter Mumbai To discourage banks from providing credit facilities to companies that refrain from adequate hedging against currency risks, the Reserve Bank of India (RBI) has prescribed additional provisioning for lenders. It has also prescribed a manner in which losses incurred on unhedged foreign currency exposure should be calculated.

According to estimates, about half the foreign currency exposure of the corporate sector is unhedged. Liabilities of companies will rise in case the rupee depreciates substantially against the dollar and its loan-servicing capacity diminishes, which could affect banks.

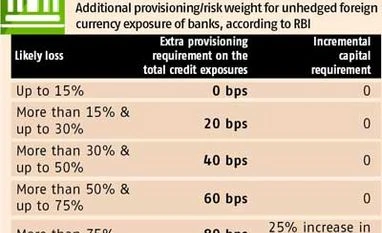

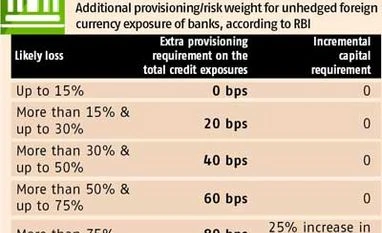

According to the final norms on unhedged corporate exposure released by RBI on Wednesday, banks have to provide 80 basis points on total credit exposure over and above the standard provisioning requirement if the likely loss is more than 75 per cent. For such losses, an additional risk weight of 25 per cent has also been prescribed.

RBI said if the likely loss was up to 15 per cent, no additional provision was required. For losses of 15-30 per cent, the additional provisioning requirement will be 20 basis points, for 30-50 per cent 40 basis points and for a likely loss of 50-75 per cent, additional provisioning will be 60 basis points.

The additional provisioning and risk weight norms will come into effect from April 1, 2014.

While banks have been asked to monitor the unhedged foreign currency exposure on a monthly basis, they have to calculate the incremental provisioning and capital requirements on a quarterly basis, at the least. “However, during periods of high dollar-rupee volatility, the calculations may be done at monthly intervals,” RBI said.

To calculate the loss for foreign branches and foreign subsidiaries, the rupee should be replaced by the currency of the country concerned, RBI said.

Since the implementation of the guidelines could pose difficulties for exposures to projects under implementation and to new entities that may not have data on annual earnings before interest and depreciation (Ebid), RBI has suggested such calculations be based on the projected average Ebid for the three years from the date of commencement of commercial operations. Provisioning for these exposures should be to the tune of at least 20 basis points.

The sharp depreciation of the rupee against the dollar in the last couple of years, particularly after May 2013, has prompted the regulator to come up with more stringent provisioning norms. The rupee, however, stabilised since September 2013, after hitting an all-time low in the last week of August, following a series of measures by the government and RBI to attract inflows and narrow the country’s current account deficit through restrictions on imports, particularly gold.

)

)