The revised estimates provided in the interim Budget peg the fiscal deficit for 2018-19 at 3.4 per cent of GDP as against the budgeted target of 3.3 per cent. But, a closer look at the numbers suggest that even the revised target might be an optimistic estimation.

The government, however, says that the fiscal deficit target has been rounded off which exaggerates the figures. In fact, the deficit has been budgeted at 3.34 per cent of the country's gross domestic product (GDP) for 2018-19 in the Budget Estimate (BE) which has now been revised up to 3.36 per cent, economic affairs secretary Subhash Garg said. This means the deficit figure has gone up by Rs 10,122 crore only in absolute terms.

However, the slippage can be higher as the government may have over-estimated its tax and disinvestment revenues, held back a part of the GST compensation cess to spruce up its balance sheet and put some of its expenses off balance sheet.

A greater than expected slippage can raise questions over the fiscal arithmetic for 2019-20.

The first evidence of this in the budget emerges from a deeper look at the tax revenue the government estimates it will be able to collect by the end of the current fiscal year, with two more months – February and March - to go.

Optimistic GST collections

The interim budget pegs collections from Central Goods and Services Tax (CGST) for the full year at Rs 5.04 trillion. This is already Rs 1 trillion lower than what the Centre had budgeted at the beginning of the year. But, even this revised CGST estimate is likely to be too high to achieve.

Data from the Controller General of Accounts (CGA) shows that in the first eight months of the current fiscal year (April-November), the government collected Rs 2.97 trillion at an average of Rs 37,160 crore per month. This includes CGST earned directly as well as that settled from the Interstate Goods and Services Tax (IGST).

To this Rs 2.97 trillion for April-November, one can add two month’s collections of CGST and the apportioned IGST for December and January. The figures for these two months are obtained from government press releases. This brings the total CGST collected by the Union government for the 10 months of April-January to Rs 3.77 trillion and an average collection of Rs 37,635 crore per month.

If one goes by the revised estimate for CGST collections presented in the Budget, the Centre would have to shore up an additional Rs 1.27 trillion in just two months. Achieving this monthly target of Rs 63,500 crore would require a whopping 69 per cent increase in the collections over the 10-month average so far.

A note on the Budget from analysts at ICICI securities corroborates this. It states, “We believe that the assumed gross revenue slippage for GST collections in FY19 – assumed to be Rs 1 trillion, or 0.5 per cent of GDP – would still prove optimistic, with another 0.25 per cent of GDP slippage likely. This slippage would mean that the FY20 growth in GST revenues would need to be about 29 per cent for hitting the budgeted targets.”

Others also concur

“For GST also the, despite the reduced estimates, the target appears optimistic (60 per cent of the Revised estimates achieved till Nov’18). How much IGST has the Centre kept and how much it is going to allocate to states will only be clear after March,” notes a report from Soumya Kanti Ghosh, Group chief economic advisor, State Bank of India.

Additionally, in its 2018-19 interim Budget, the government had targeted to collect Rs 90,000 crore as compensation cess. But in the interim Budget, it has projected to pass on to states only Rs 51,735 crore by the end of this fiscal, implying it will hold on to the balance of Rs 38,265 crore for the year. The GST Compensation to States Act, 2017 was amended to let the Centre appropriate half the unutilised cess at the end of each year. But how that would square off after state GST revenues are finally assessed and compensations paid, remains unclear.

Last three years’ data with CGA shows that owing to the corporate tax collection cycle, the government does achieve a substantial portion of its target in the last four months of a financial year. The corporate tax collected in last four months of the fiscal has ranged between 48.50-56.26 per cent of the yearly target. This year’s revised expectation puts the target for the last four months only marginally above that and therefore within achievable range.

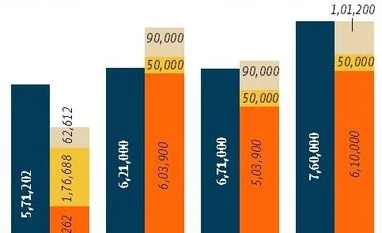

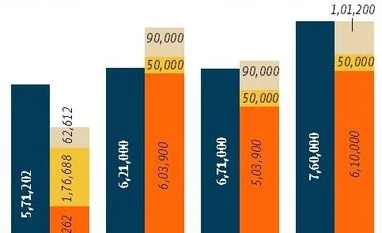

The story of optimism repeats itself on the disinvestment front. So far (by January 2019) the government had earned Rs 35,533 crore via disinvestment. But according to the interim Budget, the government is confident of meeting the Rs 80,000 crore by end of March. In other words, it expects disinvestment proceeds worth Rs 44,467 crore in merely last two months of this financial year.

Devendra Pant, Chief Economist at Ind-Ra notes that the Rs 80,000 crore target was pegged keeping in mind plans to disinvest in Air India. However, the stake sale did not find buyers. And while the PFC-REC stake sale will give the government an additional Rs 15,000 crore, it is unlikely that share buybacks and stake sales can bridge the gap in the next two months he assesses.

The revised numbers for 2018-19 also tend to show some careful accounting management on the expenditure side to keep the fiscal deficit in check.

For example, the government has been increasingly depending on the National Small Saving Funds (NSSF) to fund the Food Corporation of India’s operations. The practice started in 2016-17 when the Fund lent Rs 70,000 crore to the corporation for the first time. In 2018-19 the government had initially budgeted to bring the borrowings down to Rs 62,000 crore by repaying the fund. But in the revised numbers the total funding from the fund to FCI it now stands at Rs 94,000 crore at the end of the year – largely due to a Rs 40,000 crore borrowing in 2017-18 over and above the revised target. Despite that excess borrowing in 2017-18, the government’s repayment plan for 2018-19 remain unchanged, leading to lesser burden on the exchequer.

)

)