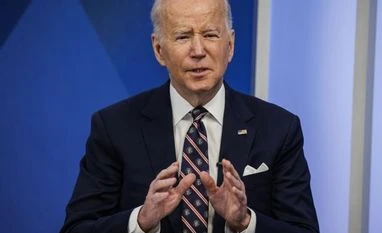

Biden to highlight US chip production in South Korea in his first Asia trip

Biden will open his trip to Asia with a focus on the Us tech sector, touring a Samsung computer chip plant on Friday that will serve as model for a $17 billion semiconductor factory

AP Seoul President Joe Biden will open his trip to Asia with a focus on the U.S. tech sector, touring a Samsung computer chip plant on Friday that will serve as model for a $17 billion semiconductor factory that the Korean electronics company is building outside Austin, Texas.

The visit is also a nod to one of Biden's key domestic priorities of increasing the supply of computer chips.

A semiconductor shortage last year hurt the availability of autos, kitchen appliances and other goods.

This supply crunch caused higher inflation that has crippled Biden's public approval and caused his administration to focus on increasing domestic manufacturing.

Biden will grapple with a multitude of foreign policy issues during his six-day visit to South Korea and Japan, but he also crafted an itinerary clearly meant to tend to the concerns of his home audience as well.

Previewing the trip aboard Air Force One, White House national security adviser Jake Sullivan said Samsung's investment in Texas will mean good-paying jobs for Americans and, very importantly, it will mean more supply chain resilience.

Greeting Biden at the plant in South Korea will be the country's new president, Yoon Suk Yeol, and Samsung Electronics Vice Chairman Lee Jae-yong.

Yoon is a political newcomer who became president, his first elected office, slightly more than a week ago. He campaigned on taking a tougher stance against North Korea and strengthening the 70-year alliance with the U.S.

Part of the computer chip shortage is the result of strong demand as much of the world emerged from the coronavirus pandemic.

But coronavirus outbreaks and other challenges also caused the closure of semiconductor plants. U.S. government officials have estimated that chip production will not be at the levels they would like until early 2023.

Global computer chip sales totaled $151.7 billion during the first three months of this year, a 23% jump from the same period in 2021, according to the Semiconductor Industry Association.

More than 75% of global chip production comes from Asia.

That's a possible vulnerability the U.S. hopes to protect against through more domestic production and government investment in the sector through a bill being negotiated in Congress.

The risk of Chinese aggression against Taiwan could possibly cut off the flow of high-end computer chips that are needed in the U.S. for military gear as well as consumer goods.

Similarly, the hermetic North Korea has been test-firing ballistic missiles amid a coronavirus outbreak, a possible risk to South Korea's manufacturing sector should the brinksmanship escalate.

In terms of chip production, China leads the global pack with a 24% share, followed by Taiwan (21%), South Korea (19%) and Japan (13%). Only 10% of chips are made in the U.S., according to the Semiconductor Industry Association.

Samsung announced the Texas-based plant in November of last year. It hopes to begin operations in the second half of 2024.

The South Korean electronics giant chose the site based on a number of factors, including government incentives and the readiness and stability of local infrastructure.

In addition to Samsung, Biden has also been highlighting in his recent speeches an announcement by the U.S. firm Intel to build a semiconductor plant near Columbus, Ohio.

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)

)