Amfi's MF platform in trouble?

Joydeep GhoshSamie ModakA number of mutual fund (MF) houses seem to be unhappy with the Association of Mutual Funds of India's (Amfi) MF platform, called MF Utility. Of the 43-entity sector, only 25 have joined it. Thus, the burden of expenses to run the platform is being borne by only these players. The problem is that fund houses are being asked to share costs according to the proportion of transactions. While fund houses are happy in paying variable costs according to the number of transactions, they want the fixed costs to be shared equally between all the fund houses. Sources say in a recent Amfi meeting, some fund houses expressed their displeasure with this costing, and suggested all fund transactions should be routed only through this platform to make it more cost-effective.

Race for assets worries fund managers A number of mutual fund (MF) houses are aggressively trying to improve their ranking by collecting assets. This should be music to the ears of fund managers but many aren't comfortable with the situation, as the fund management side has also been asked to call corporate treasury heads for investment into their schemes. "There is a question of ethics. If I am asking the company to put money in our debt schemes, it would be tough to sell their equities in the future. The Chinese wall between marketing and fund management should remain," says a fund manager.

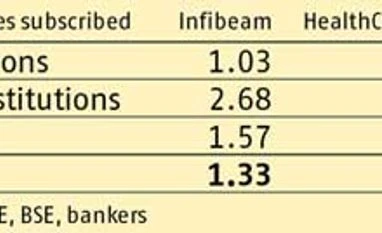

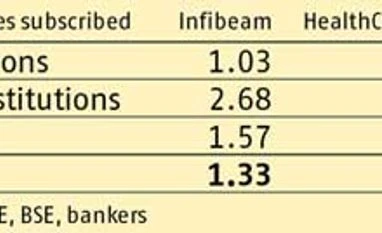

Infibeam's grey market premium drops after IPO The country's first e-commerce initial public offering (IPO) by Infibeam seems to be running out of steam in the grey market. There has been a sharp drop in the grey market premium - from Rs 40 before the IPO to less than Rs 20 after the issue. Grey market sources said this had happened due to the tepid response to the issue, which was subscribed only 1.3 times. Meanwhile, HealthCare Global Enterprises shares, too, are flat in the grey market, indicating weak opening at the bourses this week.

)

)