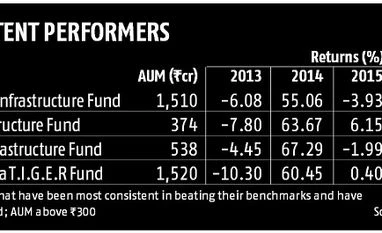

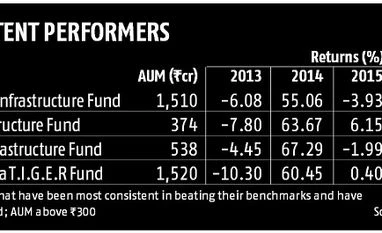

Infrastructure funds have rewarded investors handsomely over the past one year with an average return of 32.19 per cent. Much of this return has come in the current calendar year. The average year-to-date return of these funds stands at 20.50 per cent. However, the past experience is quite volatile. If you look at the calendar-year wise returns of these funds over the past six years, they have been highly volatile (See Table). Returns have been positive one year and negative in the very next. Yet, many experts believe that this sector is now on the cusp of a turnaround.

S Naren, executive director and chief investment officer, ICICI Prudential Mutual Fund believes that the infrastructure cycle began to improve from last year and is only likely to get better. “Of the total number of infrastructure companies that operated in 2007, only one-third have survived and the outlook for all these companies seems good,” he says.

The government's strong intent to revive this sector also provides reason for optimism. This year's Budget had an outlay of Rs 3.96 lakh crore for infrastructure. Schemes like Ujwal Discom Assurance Yojana (UDAY), Housing for All, Smart City Network, etc have been introduced. “Besides implementing new schemes, the government also has also embarked on a strategy to augment road and rail networks and ensure availability of power across the country, with special thrust on renewable energy. We expect higher order books and turnover for many infrastructure companies,” says Pranav Gokhale, fund manager, Invesco Mutual Fund.

The run-up in banking stocks, to which several infrastructure funds have considerable exposure, has also contributed to their outperformance. “There is a lot of bullishness about the growth in the Gross Domestic Product with the implementation of the Goods and Services Tax. The government is also displaying seriousness about tackling the problem of non-performing assets as a large part of those have come from the infrastructure sector. The run up in the banking sector stocks has contributed to the returns of infrastructure funds as well,” points out Nikhil Banerjee, a Sebi-registered investment advisor.

When choosing a fund from this category, Naren advises that you should look at the pedigree of the fund house, its risk management practices, long-term track record of the scheme, and of the fund house as a whole. Banerjee suggests investing in larger-sized funds that have been consistent performers. “If a fund manager has shown consistency with a larger portfolio in a sector that has not been investors' favourite, it is a pointer to his maturity,” he says. Invest via the SIP route to benefit from the volatility in these funds. Given their cyclical nature, Naren advises booking profits regularly in them.

)

)