The market bounced from support in the Nifty 8,450-8,500 zone and since made steady gains. Budget-related sentiments and rumours are likely to heavily influence trading. Bulls usually dominate pre-Budget trading and the expiry is pre-Budget.

The Nifty is testing resistance in the range of 8,850-8,900 and there's a good chance that we will see new all time highs. The index moved down from an all time high of 8,996, to hit support at 8,470 for a correction of 5.8 per cent. The subsequent bounce (the current phase) should take it above 8,996 to confirm the big bull market remains in force. Alternatively, the market will range trade between 8,450 and 9,000 if the mood is indeterminate.

A move below 8,470 would be considered significant by bears. The market might then dip till 8,227 to hit the Fibonacci retracement mark of 61.8 per cent. Below that, the 200-day moving average (200-DMA) is trading in the range of 7,900-8,000. If that level is broken, the big bull market would be in question.

Europe remains in turmoil and there's nervousness about China. Institutional attitude has been negative through February with FIIs being net sellers while domestic institutions have been moderate buyers. Both currency and equity volatility is likely to continue.

The rupee has appreciated a lot against euro and yen. The Reserve Bank of India (RBI) has bought the dollar in quantity to prevent over-appreciation against dollar. Crude oil has bottomed and turned around. It remains to be seen if this is temporary. But if crude does continue to harden, there will be downwards pressure on the rupee as well.

The Bank Nifty has pulled back from its peak of 20,907 and bounced from 18,225, to a current value of 19,250. The direction of the financial index is critical since it is high-beta. In general terms, positive Budget related sentiment should influence banks. But in technical terms, the Bank Nifty has an indeterminate trend. Stop-loss any BankNifty futures position at a minimum of 150 points from entry.

The Nifty put-call ratio (PCR) is neutral to mildly bearish across the one-month and three-month timeframe. The three-month PCR is at 1.05 while the February PCR is at 0.99. Premiums asymmetry is still visible with calls much more expensive. Expiry effects are not yet evident.

The February Nifty Call chain has open interest (OI) peaking at 9,000c, with ample OI till 9,500c. The implication is, a rise till 9,500 is possible. The Put OI is ample between 7,800p and 9,000p, with peaks at 8,500p, 8,600p, 8,700p and the largest block of OI at 8,300p.

The Nifty could move 200-plus points either way in a single session, and it could hit 8,300, or 9,300 within three sessions if a trend is established in either direction. Traders must be braced for that excess volatility.

The current index value is at 8,810 with futures at a premium of 35 points. The on-the-money options of 8,800p (118), 8,800c (73) are asymmetrically priced. Bears could take any bearspreads, while bulls should go slightly away from money. Strangles are also attractive.

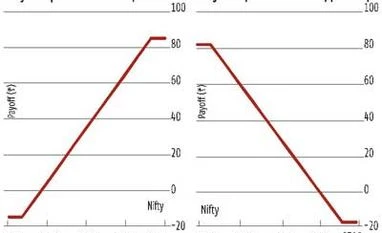

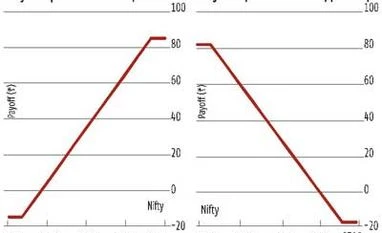

A long 8,800c (118), short 8,900c (69) costs 49, and pays 51. A long 8,900c, short 9,000c (37) costs 32, pays 68 and is quite attractive. A bearspread of long 8,800p (73), short 8,700p (42) costs 31 and pays a maximum 69, at bang on-the-money. A long 8,700p (42), short 8,600c (22) costs 20, with a payoff of 80 and this is very tempting. A long-short strangle set of long 8,700p, long 8,900c, short 8,600p, short 9,000c costs 37 and has a payoff of 63 with breakevens at 8,663, 8,937. This could be hit either or both ways.

)

)