Markets register highest weekly rise since Budget

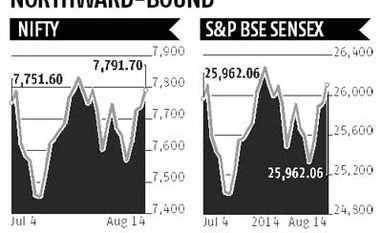

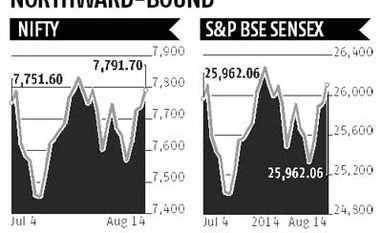

Sensex gained 3% or 774 points over the week while Nifty ended up 2.9% or 223 points

Tulemino Antao Mumbai Benchmark share indices snapped their two-week losing streak to gain three per cent in the week to August 14, the highest weekly gain since the run-up to the Budget, amid renewed buying interest from foreign funds. Further, investor sentiment got a boost after easing wholesale price inflation helped set off some of the worries over slowdown in industrial production and rising consumer price inflation.

The 30-share Sensex gained 774 points or 3.05 per cent to end at 26,103 and the 50-share Nifty gained 223 points or 2.94 per cent to close at 7,792. Earlier, in the week ended July 4, the Sensex had gained 3.4 per cent and the Nifty had ended 3.2 per cent higher.

After a slowdown in inflows in the previous two weeks, foreign funds aggressively bought Indian equities this week to the tune of Rs 1,551 crore, stock exchange data showed.

Industrial output slowed in June, though expanding for a third straight month, its best run since last September, boosting Asia’s third-largest economy, as it struggles to emerge from the longest spell of sub-par growth in a quarter-century.

Annual growth in output from mines, utilities and factories slowed to 3.4 per cent in June from an upwardly revised five per cent a month earlier, government data showed.

Pushed by food items, the Consumer Price Index (CPI)-based inflation rose to 7.96 per cent in July from 7.46 per cent in June, which was an all-time low since the new series was launched in January 2011.

The inflation in July rose mainly due to the rate of price rise in food items, which have 45 per cent weight in the CPI. Food inflation increased to 9.36 per cent in July against 8.05 per cent in June. It was 11.22 per cent in July 2013.

Unlike its retail price counterpart, the Wholesale Price Index (WPI)-based inflation declined to a five-month low of 5.19 per cent in July from 5.43 per cent in the previous month. Inflation had stood at 5.85 per cent in July, 2013. The WPI inflation came down even as food inflation rose to 8.43 per cent in July from 8.14 per cent in June. Auto, Healthcare, IT and FMCG indices were among the top sectoral gainers during the week.

Tata Motors was the top Sensex gainer up nearly 12 per cent after reporting a robust 213 per cent year-on-year jump in consolidated net profit at Rs 5,398 crore for the quarter ended June 2014 (Q1), on back of strong demand for new products, growth in volumes, richer product mix and richer geographic mix at Jaguar Land Rover (JLR). Mahindra & Mahindra ended up six per cent.

Sun Pharma ended up seven per cent after reporting a better-than-expected consolidated net profit at Rs 1,391 crore for the first quarter ended June 2014 (Q1), on back of higher sales. The country’s largest drug maker by market value had a loss of Rs 1,276 crore in the same quarter year ago.

ONGC ended up four per cent after it reported a 19 per cent rise in net profit at Rs 4,782 crore for the quarter ended June 2014. It was Rs 4,016 crore in the same period a year ago. The net sales increased 13.5 per cent to Rs 21,813 crore as against Rs 19,218 crore in June 2013.

BHEL was the top Sensex loser after a sharp 58 per cent year-on-year drop in its net profit at Rs 194 crore for the quarter ended June 30, 2014 (Q1), mainly due to decline in sales from power and industry segments. The state-owned company had profit of Rs 465 crore during the same period last fiscal.

Investors will take cues from Prime Minister Narendra Modi’s Independence Day speech in the week ahead.

Meanwhile, with first quarter earnings coming to an end and host of economic data already released markets are likely to track foreign fund inflows, rupee movement against the US dollar and fresh data on monsoon rains across the country.

)

)