The performance of three index heavyweights, Tata Consultancy Services (TCS), Infosys and HDFC, has averted a double-digit drop in benchmark indices this year, contributing 530 points to the Sensex. On the other hand, 21 declining stocks pulled the index down by 982 points.

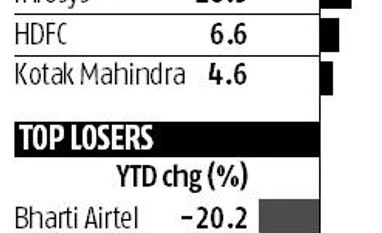

The 30-share index was largely unchanged on a year-to-date basis. However, the index came off by nearly 7 per cent from its peak 36,283 in January. Technology majors TCS and Infosys were up about 11 per cent each this year, while mortgage lender HDFC gained about 7 per cent.

State-owned Coal India was the biggest gainer this year, but it does not have much weight in the index due to its high government shareholding.

Analysis of stock-wise index contributions showed the Sensex would have been down 10 per cent from its January peak had TCS, Infosys and HDFC counters remained flat.

Stock prices have been under pressure this month due to a global rout and the Rs 114 billion fraud in the Indian banking sector.

Most global markets bounced back in the past one week. India missed the global rebound on account of weak domestic cues. Market players said investor sentiment had turned sombre because of the Punjab National Bank (PNB) fraud, widening of the current account deficit and warning by global index provider MSCI.

Banking stocks, particularly those of public sector undertakings, saw sharp declines in recent trading sessions.

“The current phase of correction in the markets is on account of domestic factors such as the PNB fraud. India might underperform in the near term, as 2018 will be a year of several domestic events. However, our fundamentals continue to look good and our markets will perform well from a long-term perspective,” said Gaurang Shah, head investment strategist, Geojit Financial Services.

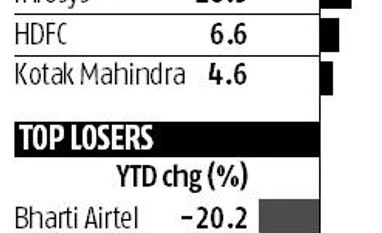

Interestingly, the biggest index laggards this year were the same stocks that were among the top performing ones in 2017. For instance, Bharti Airtel has lost 20.2 per cent in 2018 — the steepest fall among index stocks. In 2017, Airtel was one of the top index performers, with its shares gaining 70 per cent. Similarly, Maruti Suzuki soared 81 per cent in 2017 but lost 10 per cent this year. State Bank of India (SBI) shares fell about 12 per cent in 2018 because of the ripple effect caused by the PNB fraud. Together, these three pulled the Sensex down by 412 points.

A sharp rebound in technology stocks was one of the surprising themes this year. The IT stocks remained under selling pressure throughout 2017 on concerns about stricter US visa norms and muted sales. Analysts said things had started to look better for the sector as order sales from non-banking firms and artificial intelligence saw an uptick. IT stocks were heavily beaten down in 2017 and investors found good buying opportunities.

Not only Infosys and TCS, smaller IT firms such as Tech Mahindra and HCL also made stellar gains this year. Analysts said there was a lot of interest in IT stocks from both the domestic and foreign institutions as they were available at attractive valuations.

)

)