Gopal Sarma & Deepak Jain: Construction in the time of crisis

Claims takeout funds and interest subvention can shore up construction companies challenged by massive unpaid claims

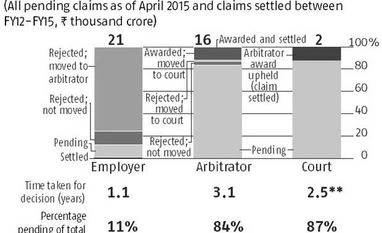

Gopal SarmaDeepak JainThe construction industry is vital to the Indian economy: the industry contributes approximately eight per cent of the national gross domestic product, employs more than 40 million people and has almost a doubling effect on other sectors. However, the construction industry faces an unprecedented crisis. Bain & Company analysed six engineering, procurement and construction (EPC) companies' pending claims data and claims settled in fiscal year 2012 (FY12) through FY15. As per analysis, more than Rs 21,000 crore of payments have been locked up in claims with arbitrators and courts as of April 2015 (Figure 1), and the average time to settle claims was 6.7 years. In addition, regulations place severe restrictions on construction companies' ability to raise funds, and customers are encashing bank guarantees as a source of financing.

The industry needs immediate intervention. Without it, the sector will spiral downward, dragging with it the economy and the central government's showpiece, the Make In India campaign. If this decline happens, easing out of the spiral won't be easy.

From a financing perspective, there is an urgent need to rationalise bank guarantee norms to meet international standards. For example, banks should provide 30 days' notice before encashing guarantees. For long-term support, an interest subvention scheme similar to those implemented for other nationally critical sectors is required, with banks distinguishing between the construction and infrastructure sectors and offering separate banking exposure limits for each.

Another solution is to ask public sector undertakings (PSU) to clear all unsettled arbitrator-awarded claims before the claims are challenged in court. However, as the burden of such payments is massive, cash-strapped PSUs will find this solution challenging to implement. An alternative approach is a "claims takeout fund", which buys, at a discount, certified claims that have gone into litigation and earns returns from eventual full-value payouts.

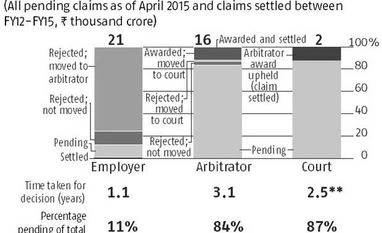

Market solution to claims funding A claims takeout fund presents a market-driven approach to the claims problem. This approach takes advantage of the reality that although EPC companies face interim cash-flow issues as a result of the long settlement times for awarded claims that move to litigation, more than 95 per cent of the claims challenged in court are awarded per the original decision of the arbitrator (Figure 2).

The claims takeout fund can buy claims at a discount. The fund, run by specialists with relevant expertise, can also streamline and better structure the management of the legal process.

The fund earns returns from the eventual full-value payout for a majority of the claims. This set-up provides multiple benefits: for the construction industry, a much-needed stream of cash and relief from the uncertainty of delayed payments; for the fund, assured cash payouts at the end of the settlement period.

The technical expertise necessary to evaluate each claim's merit and the likelihood of success, as well an estimation of a fair discounted value to buy the claim are crucial to the fund's success. The fund also requires expertise to manage legal processes as well as strong working relationships with all stakeholders.

Established models in the US and UK provide insights for the development of a claims takeout fund approach in India. In the US and UK, third-party legal financing firms provide a loan secured by collateral. The firm cannot seek out the borrower for compensation for litigants in commercial and consumer claims. These firms undertake the responsibility to pay for litigants' court costs in return for a share of the eventual recoveries. These firms undertake the responsibility to pay for litigants' court costs in return for a share of the eventual recoveries.

Interest subvention to provide cash-flow support Construction companies have large amounts of working capital tied up in financing claims and are facing soaring interest costs that are beginning to outstrip their earnings. Unsurprisingly, a majority of these companies cannot service interest costs from their cash flows. One solution is an interest subvention of nine per cent for the sector on working capital borrowings for the next five years.

The central and state governments already provide such support to sectors important to the national economy, such as cotton textiles and sugar. Initially, the total funds earmarked for capital expenditure across infrastructure sectors can allocate funds for the construction sector subvention.

The pace of infrastructure development has slowed in the past three or four years, and the construction industry has suffered from a low volume of new orders from both the government and private sectors. However, upcoming road, water and metro rail projects will feed new order generation. As these projects roll out over the next few years and pending claims are settled, EPC companies will see better cash flows and an improved ability to service debt. In the meantime, a claims takeout fund and interest subvention support will enable the industry to emerge from its current low with its capabilities and appetite intact to build the infrastructure that India needs.

The authors are partners at Bain & Company, India

These are personal views of the writer. They do not necessarily reflect the opinion of

)

)