Deepak Narhwal, 23, was playing in local kabaddi tournaments in Haryana for years. He earned Rs100,000 to Rs150,000 annually. In 2015, Narhwal started playing in the Pro-Kabaddi League or PKL. From Rs 0.2 million in season 2, his earnings have reached Rs2.5 million in season 6, which begins next week.

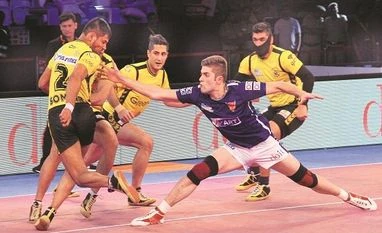

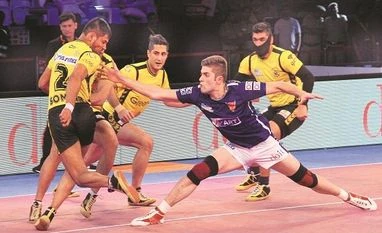

Narhwal, a raider for three-times defending champions Patna Pirates, illustrates the first of the two big changes that PKL has wrought on the sporting landscape in India. For the first time there seems to be a robust ecosystem supporting a game other than cricket. And for the first time cricket has some competition. “We have made kabaddi a career option. Earlier, playing sports other than cricket was not seen as a livelihood option,” said Uday Shankar, chairman and CEO, Star India, to Business Standard last year. “The ecosystem is being created,” says Anand Mahindra, chairman, Mahindra Group, who was among the first to see potential in kabaddi.

The first PKL in 2014 reached 128 million people. In 2017, it became the second most watched sport after cricket reaching 313 million people against the Indian Premier League or IPL’s 448 million (See: Mass appeal). In many states —Andhra Pradesh, Telangana, Maharashtra and Karnataka — kabaddi beats cricket in viewership, according to data from the Broadcast Audience Research Council. The number of teams has increased from 8 to 12, the games are bigger, and the season is longer at 13 weeks instead of five. “From where it was five years ago to where it is today, it is phenomenal,” says Nitin Kukreja, CEO, iQuest Enterprises, which owns the Tamil Thalaivas.

The revenue picture, though, remains grey. Strictly speaking, the IPL and PKL are not comparable. They are different games with different formats, length and level of maturity. But just for a quick reference, IPL (the rights to which Star owns) earned an estimated Rs20 billion this year against PKL’s about Rs3 billion in 2017. “The cumulative investment (in PKL) must be upwards of $100 million (Rs7 billion). Annually they are investing Rs1.8 to Rs2 billion. The break even is likely by 2021-22. Though many of the early franchisees have already attained break even,” says Mihir Shah, vice-president of consulting firm Media Partners Asia. “Perceptionally, the gap with cricket has narrowed but it won’t equal cricket on viewership or on rates for another 10 years,” reckons K Satyanarayana, senior vice-president, RK Swamy Media Group.

Star was better known for its tear-jerkers when it started its sports push with a commitment of Rs200 billion in 2012. Of this, 30-40 per cent was meant to go to sports other than cricket. The idea being to invest in programming that would feed its digital play (Hotstar which came in 2015) and also drive pay revenues on its linear TV business. The expectation from kabaddi was that it would pay off in three to five years. It hasn’t so far. (Star India officials did not respond to an interview request for this article.)

The challenge say team owners is that kabaddi is seen as a rustic sport. “There has to be a shift in the thinking of the sponsors. Yes, most of the players are from rural background, but it is strongly appreciated in urban centres too,” says Rajesh Shah, co-chairman and managing director of steel manufacturer Mukand Enterprises and owner of Patna Pirates.

Though about two-thirds of PKL’s viewership comes from rural areas it has strong traction in urban India too. That is evident when you see children in city parks having kabaddi matches. And many advertisers like its rustic feel. UT Ramprasad, head of marketing communications at Tata Motors, says the firm is always on the lookout for pan-Indian sports that reflect the attributes of its commercial vehicles — strength, performance and reliability. In kabaddi, it found the perfect metaphor. It started by becoming a sponsor of U Mumba, one of the teams in 2016. Last year, when UP Yoddha was formed Tata Motors became its title sponsor. The fit was perfect — it has a brand called Tata Yodha and “UP is a huge market for us,” says Ramprasad. This season Tata Motors has become an associate sponsor for PKL itself. Honda Two Wheelers is a first time sponsor on PKL. “The sport has a history of association and roots in rural India. And we have found a strong affinity between 150 cc performance bikes and contact sports (like kabaddi),” says Y S Guleria, vice-president sales and marketing, Honda Two Wheelers.

)

)