HDFC Bank is aiming to reduce its credit-deposit (CD) ratio “as quickly as possible” while maintaining its commitment to profitable growth.

However, the bank has not received a directive from the Reserve Bank of India (RBI) on the timeline to cut the ratio.

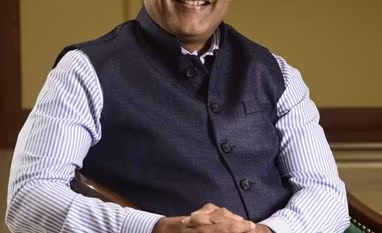

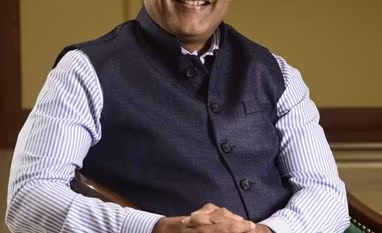

“We have not received any regulatory prescription but at the same time, the thought process is that: Can we, to the best of our ability, bring it down as quickly as possible and still maintain the objective of profitable growth,” said Sashidhar Jagdishan, managing director and chief executive officer, in an analyst call after the bank’s first-quarter (Q1) earnings.

“We are cognizant of the risks in the system and instead of being nudged on that, we want to do it ourselves because it makes economic sense to bring it down as quickly as possible”, he added.

However, Jagdishan did not specify the timeframe within which the bank would reduce its CD ratio to pre-merger levels.

“I would love to do it in one year. But it is not something that I can drop in one go. It’s not practical,” he said.

The ratio stood at 104 per cent in the quarter ended June 2024 (Q1FY25). The bank wants to bring it down to the pre-merger (with HDFC) level of 85 per cent.

Earlier Jagdishan in his message to shareholders had highlighted the bank would grow its advances slower than its deposits. This comes amid repeated warnings by the RBI, cautioning banks on the high CD ratio in the system. Recently, the RBI governor said deposit mobilisation had been lagging credit growth for some time now, and this might potentially expose the system to structural liquidity issues. The regulator’s concern is because there could be structural changes happening, which banks need to recognise and, accordingly, devise their strategies.

The bank’s senior management has stated the lender would not be involved in any competition on interest rates to attract deposits. Rather, it would rely on “engagement and service delivery” to get deposits.

“The rate is not a predominant determinant or driver for us to have an engagement. We don’t get into rate competition; we are priced fairly with our peers. And this is not something that we want to use to gather more deposits,” said Srinivasan Vaidyanathan, chief financial officer.

HDFC Bank’s deposit accretion saw a sequential decline in Q1FY25 to Rs 23.79 trillion. Commenting on the decrease, Jagdishan said: “This time around we were surprised with the period-end numbers because of some unexpected flows in the current account, which were more than what we had anticipated.”

The bank is focusing on expanding its distribution. “We have a 6 per cent market share in distribution and 8,850 branches in the country. So, we need to have a wider reach,” Vaidyanathan said.

Having brought in new customers, the bank will engage with them by providing best in class services and look to broadbase relations with such customers to keep growing the balances.

In Q1FY25, the bank brought in 2.2 million customers.

The private-sector lender has indicated it will be cautious in selecting and pricing opportunities in both wholesale and retail loans. This strategy ties in with its intention to grow advances more slowly than deposits, aiming to reduce loan-to-deposit ratios more rapidly.

“In the wholesale category, credit demand is high but the rates are benign. The spread on these loans over risk-free government securities is thin and competition is making it thinner. Given that, we want to ensure that we are circumspect in how we price and choose,” Vaidyanathan said.

“On retail, in secured segments such as mortgages, we are the leader after the merger and we will continue to be leading in this segment. On the unsecured segment, we have heard the regulator talking about being cautious about credit quality and end use.

So, we have to be cautious and we have been cautious in this segment. Our growth in this segment was about 10 per cent on an annualised basis and we will calibrate the rate of growth,” he said.

HDFC Bank reported 52.5 per cent year-on-year growth in advances in Q1FY25 at Rs 24.63 trillion. Sequentially, they were up 0.8 per cent.

Board approves listing of HDB Financial

HDFC Bank said that its board of directors have given an in-principle approval to initiate the listing of HDB Financial Services, a subsidiary of the bank, through an initial public offering (IPO).

In a call following the bank’s June quarter earnings, Srinivasan Vaidyanathan, the bank’s CFO, said: “The IPO process is mandatory and it has to be completed by September 2025 as per Reserve Bank of India regulation. And, the board has given approval to initiate the process, subject to regulatory approvals”. Additionally, he said the bank is open to selling stake in HDB Financial Services outside the IPO process but there is no discussion so far.

)

)