Bharti Telecom plans its biggest-ever rupee bonds worth Rs 8,000 cr

The issuance is also Bharti's first in the onshore market in almost a year. It raised Rs 3,200 crore through three-year notes in December last year

)

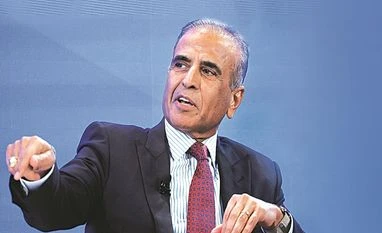

Bharti Enterprises Founder and Chairman Sunil Mittal

Listen to This Article

Divya Patil

Bharti Telecom Ltd., owned by Sunil Bharti Mittal, is planning to raise as much as Rs 8,000 crore ($961 million) in the local-currency bond market, according to people familiar with the matter.

The company is expected to seek bids this week for notes due in two-, three- and five years, the people said, who asked not to be identified as the details are private. If the deal goes through, it will be Bharti Telecom’s largest ever rupee issuance, according to data compiled by Bloomberg.

Bharti Telecom is coming to the bond market at a time when its unit, which is India’s second-largest wireless carrier Bharti Airtel Ltd., is rolling out 5G services across the country as it taken on its rival billionaire Mukesh Ambani’s Reliance Jio Infocomm Ltd.

The issuance is also the Bharti’s first in the onshore market in almost a year. It raised Rs 3,200 crore through three-year notes in December last year.

More From This Section

Topics : Sunil Mittal Bharti Telecom rupee bond

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Nov 29 2023 | 4:07 PM IST