Specialty ingredients giving a facelift to personal care products market

Increasing demand for personal care products in India is leading to manifold rise in demand for specialty ingredients, says Tata Strategic Management Group

Manish PanchalCharu Kapoor B2B Connect | Mumbai

)

Indian personal care product market is observing different trends for different users. On one hand we have urban customers whose needs are evolving and require customisation of the product offering. On the other hand, we have rural customers where the penetration is increasing, but their price sensitivity requires cost effective product offerings. These trends make it imperative for specialty ingredient producers to re-define their market positioning from anywhere between a niche player to an integrated player.

Back to basics

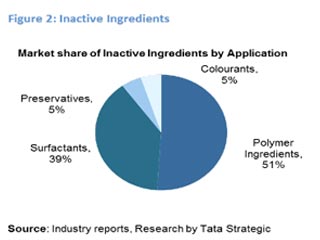

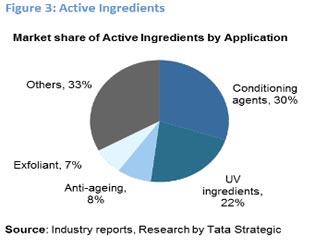

Almost all of us are attuned to using hair care, skin care & bath products, cosmetics and fragrances. Together these products form the personal care product market. What we may be oblivious to is the fact that all these products are a result of the specialty chemical ingredients used in them. Specialty ingredients in personal care products account for physical properties (inactive ingredients) and functional properties (active ingredients). The inactive ingredients include: surfactants, preservatives, colourants and polymers. Whereas the active ingredients include: anti-ageing materials, exfoliators, conditioning agents, and UV agents etc.

ALSO READ: FMCG companies banking on specialty chemicals to achieve sustainability

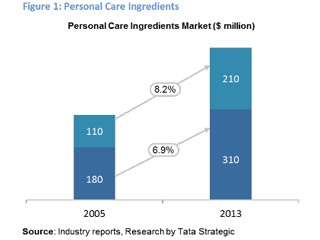

Personal care ingredients market in India is currently valued at about $ 520 million. Inactive personal care ingredients account for 60% of the market. Revenues have grown at 7% per annum to reach about $ 310 million in 2013. Rising use of polymer ingredients and surfactants together have been the key drivers and these currently account for 90% of the market (Refer Figure 2). More than 80% of the inactive ingredient demand is met through local production. Imports are restricted to some special inactive ingredients only.

Active ingredients account for the remaining 40% of the market. Revenues have grown at 8.2% per annum to reach about $ 210 million in 2013. The market for active ingredients is far more scattered with numerous applications (Refer Figure 3).

In recent years, the personal care ingredients market has been impacted by trends such as evolving consumer needs leading to product differentiation; increasing penetration in both urban and rural markets; innovations driven by market needs; and regulatory regimes driving investments in R&D & increase consolidation/tie-ups.

Product differentiation to meet evolving needs

Needs of urban consumers are evolving. From use of generic personal care products their demand is shifting to products suited for specific needs. For example, products specific to different skin types; hair solutions ranging from strengthening to shining to long lasting properties; lipstick needs vary depending on season or geography (matte in summer – glossy in winter; brighter shades in north – subtle shades in west). These urban users are also willing to pay a premium for customised products.

These trends provide an opportunity for product manufacturers to differentiate themselves by catering to the specific needs of different regions and demographic segments.

Tapping the urban and rural markets

India is a diverse market with urban, semi-urban and rural consumers. The penetration of personal care products in urban areas is high and the target is to develop new consumer segments. Some product manufacturers have effectively innovated to increase sales in urban areas. For example, children are keen to buy hand sanitisers that come in small bottles. This trend is the result of increased awareness and innovative packaging. Such trends can create demand for some specialty chemical ingredients.

ALSO READ: Evonik plans tie-up with Indian research institutes for growth

As for semi-urban and rural India the penetration has been relatively low. The rural consumer’s high price sensitivity, lower disposable income and lack of awareness have been the major constraints. However, increasing economic wealth, growing urbanisation, changing lifestyles and increasing awareness owing to exponential rise of mass media advertisements is likely to result in an increase in penetration as well as increase in per capita consumption on personal care products.

Market-needs driven technical innovations

The market is exhibiting demand for natural ingredients as customers are becoming more aware about the contents of the products they use. With some products being considered carcinogenic and already being banned in foreign countries, there is a shift in Indian markets too.

Micro encapsulation serves as a good example of technical innovation in delivery mechanism of end products. In this, specialty ingredients are packaged in micro capsules which are released when applied. This prolongs the shelf life, enhances the impact of ingredients, masks their undesired properties and allows reactive ingredients to be protected from environmental contact.

Regulatory impact on R&D and consolidation

In India, there are multiple and complex regulations under different bodies leading to a lack of implementation of set guidelines and laws. This makes the creation of a reputation among product manufacturers a critical success factor. Improving standards due to entry of foreign producers is not going to make this easy.

India also has non-uniform licensing policies across states. Each state has its own standards with considerable variations in each state. This acts as a regional entry barrier protecting regional specialty ingredient producers. Thus for foreign MNCs, who are trying for a faster and pan-India presence, it is desirable to tie-up with regional producers.

ALSO READ: Brenntag acquires Zytex Group's chemical distribution division

Going ahead, an integrated legislation like REACH (Registration, Evaluation, Authorization and Restriction of Chemicals), could come into effect resulting in reduction of regional entry barriers. This would imply that either the regional manufacturers invest or perish.

Way ahead

The needs of product manufacturers are driven by end consumers. Based on increasing awareness and evolving consumers, premium segments offer huge growth potential in India. These consumers are also ready to spend more on quality products. Product customisation/ differentiation is a direct result of specialty ingredients being used. This makes R&D of specialty ingredients a key focus area. Specialty ingredient producers can leverage their local presence and work in tandem with product manufacturers to map the evolving needs of different regional and demographic segments. With this market research and proactive investment towards technical innovation they can enhance the differentiation/customisation of products and in turn develop a niche position.

In generic segments, increased penetration in rural areas is likely to increase the market size. Hence, the thrust on these products is expected to continue in the next 4-5 years. Specialty ingredients account for a significant portion of cost for these products. To address the need of price sensitive end consumers, the pressure of cost reduction will fall upon specialty ingredient producers. This will imply that specialty ingredient producers should increase their focus towards developing robust sourcing strategy and streamlining of operations.

Also, some specialty ingredient producers would not be able to invest in R&D on a large scale or grow beyond certain regions. Hence, the market will see consolidation, mergers & acquisitions, and alliances. Foreign MNCs may also need to tie up/ acquire local producers to increase their pan-India presence at a faster pace for both segments.

Overall, the time has come for specialty ingredient producers to clearly define their future objective and develop a strategic roadmap to establish their desired position in this continuously evolving value chain.

________________________________________________________________________________________________

Manish Panchal is the Practice Head - Chemicals, Energy and Supply Chain at Tata Strategic Management Group (a management consulting firm).

Charu Kapoor is the Engagement Manager – Chemicals at Tata Strategic Management Group

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Oct 28 2013 | 5:36 PM IST