Retail inflation cools to over two-year low in May; IIP growth recovers

Food inflation fell to an 18-month low of 2.91 per cent in May from 3.84 per cent in April

)

Headline inflation, thus, stayed within the Reserve Bank of India’s (RBI’s) upper tolerance limit for the third consecutive month in 2023

Listen to This Article

India’s retail inflation rate cooled to a 25-month low in May on the back of a high base and easing price pressures across categories, giving the central bank elbow room to maintain an extended pause on policy rates. The Index of Industrial Production (IIP), on the other hand, recovered in April due to good performance by the manufacturing and mining sectors, data released by the National Statistical Office (NSO) showed on Monday.

The Consumer Price Index (CPI)-based inflation rate stood at 4.25 per cent in May, as against 4.70 per cent in the previous month, because of a decline in food, fuel, clothing and services prices, according to the data.

Headline inflation, thus, stayed within the Reserve Bank of India’s (RBI’s) upper tolerance limit for the third consecutive month in 2023.

The RBI has an inflation target of 4 per cent, with a margin of 2 percentage points on either side. However, RBI Governor Shaktikanta Das, after the monetary policy review earlier this month, said, “Our target and endeavour is to see that headline inflation aligns with the target on a durable basis. The primary target of monetary policy is 4 per cent.”

Meanwhile, IIP growth rebounded to 4.2 per cent in April from 1.1 per cent in March, largely due to an increase in output growth in manufacturing (4.9 per cent), while growth slowed in mining (5.1 per cent). Electricity witnessed a contraction (-1.1 per cent), the data showed.

Also Read

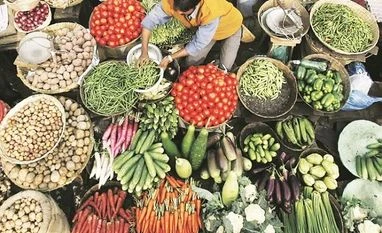

Food inflation fell to an 18-month low of 2.91 per cent in May from 3.84 per cent in April.

The fall in food inflation was mainly driven by a deceleration in the prices of cereals (12.65 per cent), fruits (0.70 per cent), non- alcoholic beverages (3.71 per cent), and prepared meals (6.36 per cent), and a continued contraction in the prices of meat and fish (-1.29 per cent), oils (-16.01 per cent), and vegetables (-8.18 per cent). Prices of protein-rich items like egg, milk and pulses accelerated 6.71 per cent, 8.91 per cent and 6.56 per cent, respectively.

Core inflation, which excludes volatile food and fuel items, remained below 6 per cent for the third consecutive month due to a deceleration in price rise of services like education, recreation, personal care, transportation, household, and health services. It, however, remained above the headline figure in May as well.

Aditi Nayar, chief economist at ICRA, said although the lower-than-expected retail inflation print was chiefly driven by the food and beverages segment, concerns remained about the potential impact of a sub-par monsoon on food inflation in the second half of FY24.

“The onset of the monsoon has been delayed, and the pan-Indian rainfall has been deficient so far in June. While seasonally healthy reservoir levels are likely to provide some respite, a normal distribution of rainfall in July will be critical to ensure timely sowing of kharif crops over the majority of the country, thereby impacting crop output and food inflation,” Nayar added.

In IIP, growth in output of primary goods (1.9 per cent) and capital goods (6.2 per cent) decelerated in April, whereas the output growth of infrastructure goods (12.8 per cent) and intermediate goods (7.1 per cent) accelerated.

Growth in consumer durables (-3.5 per cent) contracted for the fifth consecutive month in April, signaling continued weakness in consumer demand, whereas the output growth of consumer non-durables (10.7 per cent) accelerated from the contraction seen in March.

Only 12 of the 23 manufacturing sectors registered growth in April, as sectors like textiles (-6.3 per cent), tobacco (-21.3 per cent), apparel (-29.1 per cent), and leather products (-6.5 per cent) contracted in the month.

Madan Sabnavis, chief economist, Bank of Baroda, said manufacturing drove the growth in IIP, besides sectors related to government spending doing well in April.

Rajani Sinha, chief economist, CARE ratings, said the RBI was expected to maintain a status quo in 2023 with CPI inflation remaining above the 4 per cent target and growth impulses expected to hold up well.

Echoing similar views, Nayar added that the hawkish tone of the June policy document implied that a pivot to rate cuts was quite distant and an extended pause was expected through FY24 with the stance remaining unchanged over the next couple of policy meetings.

More From This Section

Topics : CPI IIP India inflation retail inflation

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Jun 12 2023 | 10:15 PM IST