Infrastructure AIFs in slow mode despite a govt push for new roads, ports

Commitments to such funds have grown significantly slower than overall AIF commitments

)

premium

3 min read Last Updated : Jun 13 2023 | 8:57 PM IST

Listen to This Article

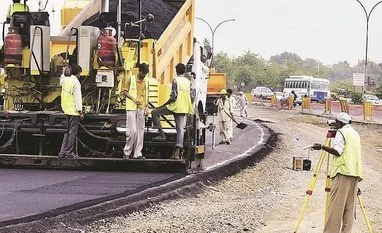

Investment vehicles for the rich which focus on opportunities in the infrastructure space are growing slowly, notwithstanding massive government push for new roads, railways, and ports.

Infrastructure alternative investment funds (AIFs) have seen commitments from wealthy investors rise 29 per cent since March 2019 to Rs 15,581 crore. Overall AIF commitments have risen 196 per cent to Rs 8.3 trillion in the same period.

An AIF requires a minimum investment of Rs 1 crore.There are three categories of AIFs.

Category I includes venture capital funds which invest money in start-ups, social ventures, small and medium enterprise funds, and infrastructure funds. Category II includes funds investing in distressed debt.

Category III includes hedge funds which use complex strategies to make money from stock markets —whether they move up or down.

The share of infrastructure funds in commitments raised has fallen from 4.3 per cent in March 2019 to 1.9 per cent in March 2023. It accounted for nearly a fifth of total AIF commitments in March 2016.

Commitments reflect the intent to invest. The actual funds raised through infrastructure AIFs so far is Rs 5,466 crore as of March 2023. The total investment made is Rs 4,743 crore. The share in the amount raised is 1.5 per cent of the overall AIF funds raised. The share of investments made is 1.4 per cent.

The government had announced a Rs 111 trillion infrastructure National Infrastructure Pipeline (NIP) in 2019 to be rolled out between financial years 2019-20 (FY20) and 2024-25 (FY25).

“To increase private sector participation in the creation of new infrastructure and development of existing ones, the government took initiatives like public-private partnership, NIP, and National Monetisation Pipeline (NMP),” observed the 2022-23 Economic Survey.

It said that the sale of assets to the private sector is expected to help fund infrastructure requirements.

“It is expected that private players would operate and maintain the assets. The NMP provides an opportunity for deleveraging balance sheets and providing fiscal space for investment in new infrastructure assets. The estimated aggregate monetisation potential under NMP is Rs 6 trillion through core assets of the central government, over four years, from FY20-25,” added the Economic Survey.

The ambitious plan comes on the back of nearly a decade of lower private sector participation in Indian infrastructure projects.

The peak private sector investment was in 2010 when it touched $50 billion. It has been under $10 billion every year after 2012, until it touched $11.9 billion.

Private infrastructure investment was $7.4 billion in 2019, reveals data from the World Bank. This dropped to $5.2 billion in 2020 during the first year of the pandemic in India. The numbers began to rise again in 2021 ($7.7 billion) and 2022 ($11.9 billion).

The potential for infrastructure AIFs is large, but it has not yet translated into appetite on the ground even in 2023, according to Daniel G M, founder-director at industry-tracker PMS Bazaar.

“There is no traction for this kind of fund lately,” he added.

Types of AIFs

CATEGORY I

Infrastructure funds

Venture capital funds

Angel funds

Social venture funds

CATEGORY II

Debt funds

Fund of funds

Private equity funds

CATEGORY III

Hedge funds

Private investment in npublic equity fund

Topics : AIF Ports in India