Sensex plunges over 5,000 points intraday; check factors behind the fall

The sharp drop was primarily driven by uncertainty surrounding the outcome of the Lok Sabha 2024 election results

)

Listen to This Article

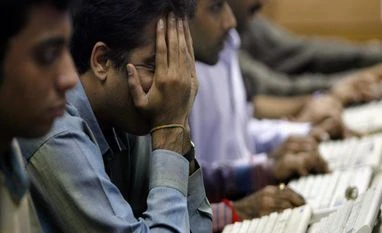

Lok Sabha Elections impact: The benchmark Sensex dropped as much as 5,661 points, or 7.40 per cent, to hit an intraday low of 70,785.12 levels, on Tuesday, June 4.

The sharp drop was primarily driven by uncertainty surrounding the outcome of the Lok Sabha 2024 election results.

NDA tally falls behind market expectations: According to reports, the NDA was leading with 295 seats at 11.20 AM, while the INDIA alliance secured 228 seats. Others added 20 seats to the tally.

With expectations mixed, all but HUL among the stocks in the 30-share Sensex were trading in the red.

SBI, NTPC, and Power Grid were among the top losers. Conversely, HUL rose up to 3.06 per cent to hit an intraday high of Rs 2,427.

Also Read

Heavyweight stocks drop: Reliance Industries (528 points), HDFC Bank (421 points), SBI (373 points), ICICI Bank (323 points) and L&T (334 points) were among the top contributors to the fall in the benchmark index at around 12 noon.

Larsen & Toubro (down 8.3 per cent at Rs 3,500 levels), RIL (down 6 per cent at Rs 2,800 levels), ICICI Bank (down 4.6 per cent at Rs 1,100 levels) and HDFC Bank (down 3.5 per cent at Rs 1,510 levels), were among the top stocks of private sector players that saw a major drop in trade on Tuesday.

INDIA VIX highest in 9 years: India VIX, or India Volatility index, soared 42.26 per cent to 29.79 levels, which is the highest in 9 years.

PSUs see a sharp drop: The majority of PSU stocks hit lower circuit levels due to uncertainties regarding the potential number of seats the BJP-led NDA would secure.

According to V K Vijayakumar, chief investment strategist of Geojit Financial Services, “The steep fall is due to the results so far falling short of the exit polls which the market had discounted yesterday. If BJP doesn’t get a majority on its own there will be disappointment and this is getting reflected in the market. Also it is possible that Modi 3.O may not be as reform-oriented as the market expected and may turn more welfare- oriented. This is reflected in the strength in FMCG stocks.”

In contrast, shares of fast-moving consumer goods (FMCG) companies surged up to 5 per cent amid heavy trading volumes, bucking the overall weak trend in the market, driven by optimistic outlooks.

Dabur India, Colgate-Palmolive (India), Marico, Hindustan Unilever (HUL), Emami, and Britannia Industries all saw gains ranging from 2 per cent to 5 per cent on the BSE during Tuesday's intra-day trading session.

More From This Section

Topics : Markets Sensex Nifty MARKETS TODAY Indian equities Indian equity markets Indian stock market Indian stock markets BSE NSE Reliance Industries HDFC HDFC Bank HDFC Bank ICICI Bank L&T Lok Sabha elections Election Results 2024 BJP Congress stock market trading share market

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Jun 04 2024 | 11:54 AM IST