Wholesale despatches of all automobile segments, from manufacturers to dealers, expanded in high double-digit last month over the same period a year before.

This was due to the low base of June 2017, when dispatches had slowed, owing to the transition to the national Goods and Services Tax (GST) regime. Most segments saw a decline in June last year; some had managed low single-digit growth.

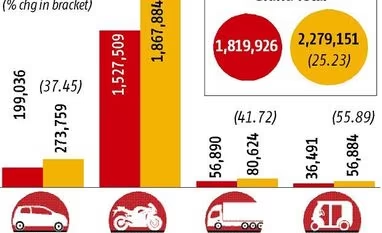

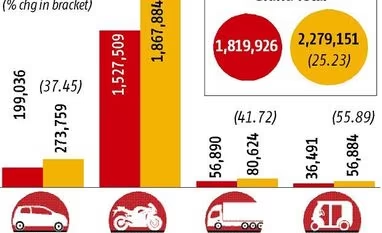

Data from the Society of Indian Automobile Manufacturers (Siam) show sale of passenger vehicles (cars, utility vehicles, vans) grew 37.5 per cent last month to 273,759 units. Within this segment, those of cars grew 34 per cent to 183,885 units; vans grew 35 per cent to 16,220 vehicles. The sub-segment of utility vehicles surged 47 per cent, to 73,654 units.Maruti Suzuki, Hyundai, Tata Motors and Toyota all reported double-digit growth.

“People postponed purchases last year during this period; they expected prices to come down following the rollout of GST. So, the growth this year is coming on a low base,” said Vishnu Mathur, director-general at Siam.

Growth over the three months in the June quarter was also good -- passenger vehicle sales rose 20 per cent, against 4.4 per cent last year. Mathur says this is a cyclical industry and is currently passing seeing an up-cycle.

Domestic two-wheeler sales in June rose 22.3 per cent to 18,67,884 units from the year-before month. The rate of rise for motorcycles was more than of scooters for a fifth month in a row, rising 24.3 per cent to 11,99,332 units, while scooters grew 21 per cent to 601,761 units.

The quarter’s growth for motorcycles and scooters was 19.5 per cent and 10.35 per cent, respectively. The segment’s growth was almost 16 per cent.

Sale of commercial vehicles (CVs) was up 41.7 per cent to 80,624 units in June. Both light CVs and medium and heavy CVs (M&HCVs) grew in excess of 40 per cent. The quarterly growth in CVs was 83.6 per cent, again due to a low base effect.

“M&HCVs are expected to carry forward the momentum in the year, with greater demand for HCVs on the back of strict implementation of overloading norms across a majority of states, better road infrastructure and implementation of e-Way Bills under GST. LCVs registered a 11th consecutive quarter of growth, helped by consumption-driven sectors, e-commerce companies and signs of a good monsoon,” said Rakesh Batra, partner at consultancy EY.

The June quarter, first in the financial year, is usually one of low growth for the automobile industry. The pace picks up in the second quarter (July-September), when festive demand begins. One could expect the second quarter to be a period of strong growth for the industry, aided by normal rainfall and increase in support prices of agricultural crops. Factors like higher fuel prices, firm commodity prices and a volatile foreign exchange rate are yet to make a visible dent on demand.

)

)