Car sales rise for the first time in 3 years

Commercial vehicles however declined by 2.8% to 614,961

BS Reporter New Delhi Sales of passenger cars in India rose by almost 5% to 1.87 million in 2014-15 after a decline in the previous two years.

In the past two financial years (ending March 31), car sales dropped 7.7% and 4.7%, respectively, according to data from the Society of Indian Automobile Manufacturers (Siam).

“During FY15, general sentiment improved in the car industry. Investment cycles restarted and the worries which people were having was greatly diminished,” said Siam director-general Vishnu Mathur. Beside, interest rates and fuel rates came down, reducing the overall cost of ownership, he added.

However, the absolute number of sales was still far below the total number of cars sold in the year ended March 2011. “The overall yearly performance is far from satisfactory,” said S. Sandilya, former president of Siam.

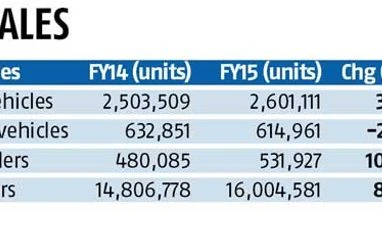

During the year, automobile makers launched 27 new models, 26 refreshed models and 37 variants of new models. According to Siam data, the overall passenger vehicle industry — including sales of cars, utility vehicles and vans -- grew 3.9 per cent to 2.6 mn units in 2014-15.

However, commercial vehicles declined 2.8 per cent to 614,961, though sales of medium and heavy CVs increased 16 per cent to 232,755 units. Mathur said sales of heavy trucks had gained due to the start of various infrastructural activities like mining and construction of roads, while sales of light CVs have still not picked up. “The ntotal volume of medium and heavy CVs is far lower than in 2011-12,” said Sandilya.

Sales of two-wheelers grew 8.1 per cent to 16 mn, backed by strong scooter sales. Scooters as a segment grew 25 per cent to 4.5 mn in 2014-15. Motorcycle sales, however, fell 2.5 per cent to 10.7 mn.

“Motorcycle sales were impacted due to moderate demand from rural markets, which saw limited rainfall last year. Now, the rural markets have been impacted by unseasonal rain,” said Mathur.

During 2014-15, overall automobile exports grew 14.9 per cent to 35,73,806 units, compared to 31,10,584 units in 2013-14.

On 2015-16, Mathur said the industry was “hoping for a moderate growth”.

Honda, Hyundai and Maruti Suzuki attracted most of the customers in the passenger vehicle segment, with fresh launches. During FY15, Honda’s domestic sales grew 40.7 per cent, Maruti Suzuki by 11.1 per cent and Hyundai by 10.6 per cent, according to Siam data. Sales of Fiat, Ford, General Motors, Renault, Skoda, Tata Motors and Volkswagen declined.

)

)