GVK fails to pay $560 million for mines in Australia

$10-billion project stranded due to falling coal prices

Dev Chatterjee Mumbai The GVK Reddy family, which took over the Hancock coal mines in Australia for $1.26 billion in 2011, has failed to pay the final tranche of $560 million to the Australian billionaire Gina Rinehart-owned Hancock Prospecting, putting a question mark over the future of the project.

GVK was initially planning to invest $10 billion in developing three coal mines and infrastructure in Australia's central Queensland.

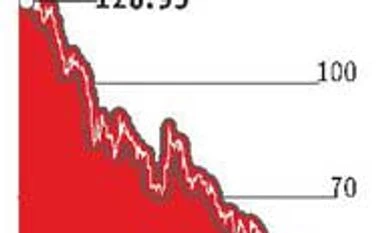

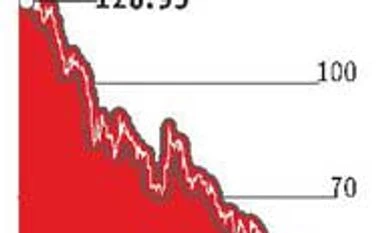

Bankers said the project was now stranded and till coal prices recovered from their historic lows the project was not expected to take off. Coal prices have dropped from $121 a metric tonne in March 2011 to $52 now (see chart).

The Reddy family owns a 90 per cent stake in the Singapore-based company that is developing the project while GVK Power and Infrastructure owns the rest. An email sent to the GVK group did not draw any response.

Last Sunday, the Adani group announced it had received mining leases for its Carmichael coal mine project in Queensland.

The difficulty of the GVK group in paying for acquisition or developing the project stems from the fact Chinese coal imports have dropped 20.1 per cent, year on year, in the first two months of 2016 following a 30.4 per cent decline in 2015.

Besides, China Shenhua has announced that its coal exports will grow fivefold in 2016 and China will return to being a net exporter from being the world's largest importer.

GVK had acquired 100 per cent of the Kevin's Corner coal deposits and 100 per cent of the Hancock rail and port infrastructure projects, plus a 79 per cent stake in the Alpha and Alpha West coal deposits.

The payment was staggered over three years with the last tranche of $560 million to be paid by September 2014. The deadline was extended as coal prices fell sharply and there were no other takers. GVK was targeting production by 2014.

Indian coal imports have dropped 15 per cent in 2015-16 and Coal India has reported its highest ever production during the year.

Analysts said all these factors were making Australian coal mine projects unviable. Besides, there is stiff opposition from local environment activists against the project.

)

)