Motorcycle sales to remain in slow lane

This trend in motorcycles, impacted by rural demand, is in sharp contrast to a double-digit growth in demand for scooters

Ajay Modi New Delhi Two-wheeler makers seem faced with lacklustre motorcycle demand for at least the first half of this calendar year, a segment spoilsport in an otherwise buoyant automobile sector.

This trend in motorcycles, impacted by rural demand, is in sharp contrast to a double-digit growth in demand for scooters.

Delhi-based Hero MotoCorp, with a little over 50 per cent in the domestic motorcycle market, anticipates a change in rural sentiment only if the monsoon doesn't play truant this year. The country has seen two deficit monsoons, impacting the rural economy. Sales of motorcycles declined 2.5 per cent in the first nine months of the current financial year, when sales of scooters grew 11.4 per cent. Rural markets account for more than half of motorcycle sales.

Abdul Majeed, a partner at Price Waterhouse and an expert on the sector, said normal rainfall could trigger two to three percentage points of growth in motorcycles.

"The current sluggishness is reflective of the overall sentiment in rural markets, on account of consecutive sub-normal monsoons, moderate growth in rural wages and in minimum support prices. The industry expects motorcycles to remain subdued at least for a couple of quarters. If we have a good monsoon and sentiments change in the rural market, then the motorcycle market might see a positive turnaround in the second half of the next financial year," said a Hero MotoCorp spokesperson.

The worst affected is the entry category of up to 110cc engine capacity, where most companies are present and which is at least 60 per cent of the motorcycle market. Sales in this segment declined almost six percentage points during April-December 2015, to 5.06 million units.

Not that all motorcycle segments are on a decline. Models with higher engine capacity, which have a larger market in semi-urban towns and cities, have done well. The 110-125cc category, for instance, grew a little over five percentage points. Those of 250-350cc grew 55 per cent, where Eicher's Royal Enfield is the key player.

It is mainly the entry segment that is pulling down the numbers. "We see motorcycles remaining stressed due to the rural economy. The major contribution to motorcycles comes from the 100-110cc segment. This is the worst hit, as it depends largely on rural market. We don't see any immediate recovery in footfalls and interest. The next important event will be monsoon. If normal rainfall happens, rural demand will go up", said Y S Guleria, senior vice-president (sales and marketing), Honda Motorcycle and Scooter India.

Companies have decided to go slow on new launches in the entry segment. "We were able to read the rural trend early and our product line-up in 2015 was primarily developed keeping in mind the urban and semi-urban market," added Guleria.

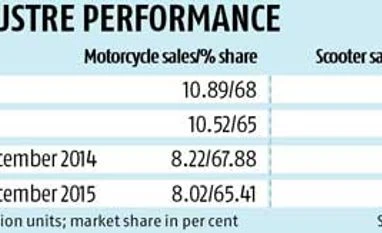

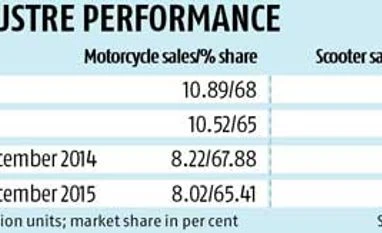

Scooters formed 30 per cent of the 16-million unit market for two-wheelers in calendar year 2015, against 27 per cent in 2014. Motorcycles were down from 68 per cent in 2014 to 65 per cent in 2015. A total of 16.12 mn were sold in 2015, up by only 0.9 per cent. A small five per cent share comes from mopeds, again a declining segment. The share of scooters is projected to grow further.

)

)