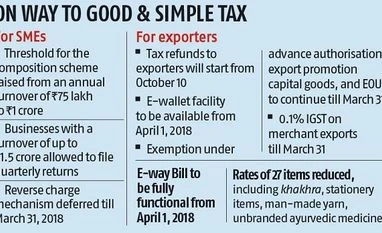

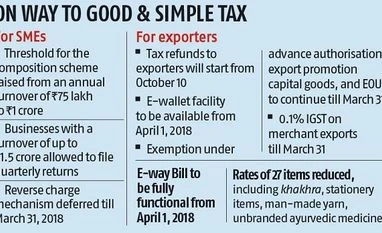

The Goods and Services Tax (GST) Council on Friday took major decisions to prevent working capital of exporters from getting locked up and reduce the compliance burden on small and medium enterprises, while reducing rates on 27 items of daily use, including khakhra, which may help the ruling party, the BJP, in poll-bound Gujarat.

It deferred implementing the controversial e-way Bill and the reverse charge mechanism.

The Council also postponed imposing tax deducted or collected at source, which will particularly benefit e-commerce companies. It also decided to set up a committee to frame principles to reduce rates, depending on revenue patterns of the GST so that no ad hoc decision was taken, said Finance Minister Arun Jaitley, who chaired the Council meeting.

Exporters will start getting credit for the integrated GST (IGST) paid for July from October 10 and for August from October 18. Other refunds of the IGST paid on supplies to special economic zones (SEZs) and of input taxes on exports under bonds or the letter of undertaking would also be processed from October 18.

Both Central and state officials will be empowered to do so. The decision, an interim one, was based on the recommendations of a committee headed by Revenue Secretary Hasmukh Adhia.

Besides, there would be long-term solutions for exporters — a facility of e-wallet will be set up, preferably by April 1 next year.

The Council allowed those with an annual turnover of up to Rs 1.5 crore to file returns and pay taxes quarterly from October.

It also raised the eligibility limit in terms of annual turnover to Rs one crore from the current Rs 75 lakh for the composition scheme, which allows a flat rate and easy compliance. The assessees are required to file and pay taxes only quarterly under this scheme.

Under the scheme, a trader pays the GST at one per cent, a manufacturer at two per cent and a restaurant owner at 5 per cent, but they are not allowed input tax credit. And they are permitted to file quarterly returns.

Archit Gupta of ClearTax says, “Unless the scope of the composition scheme is widened it may not see much favour. The services sector is still devoid of the benefits of this scheme.”

The Council deferred the reverse charge mechanism (RCM) till March 31, 2018. In the GST the one selling goods and services has to pay the tax. But under the RCM, those buying goods and services from unregistered entities have to pay the tax. This move will help many companies but it will be particularly helpful for small enterprises since bigger companies were asking them to register.

Those with an annual turnover of Rs 20 lakh are exempt from registration.

The controversial proposal of the e-way Bill has also been put off. It is in force in Karnataka on an experimental basis. Jaitley said the experiment had been successful. It will be put in place in other states from January next year till March 31 of that year.

But the e-way Bill has been notified. The Bill is required even if goods are transferred from one vehicle to the other.

Pratik Jain of PwC says, “Industry would hope that GST council would carry out a detailed study for the need of such a system and a decision would be taken after proper consultation with all stake holders.”

In what will benefit e-commerce companies, the Council also postponed tax collected at source, which will give e-commerce companies a breather.

The Council constituted a group of ministers to study whether those under the composition scheme could be allowed to engage in inter-state business, whether goods exempted from the GST will also be taxed under the composition scheme, if two per cent tax on manufacturing under the composition scheme will also be allowed input tax credit and whether tax on restaurant owners be reduced from 18 per cent to 12 per cent without input tax credit as there are complaints that they are not giving benefits to customers. There was no unanimity on these issues in the Council.

)

)