IRDAI to bring out host of new regulations to support insurance ordinance

New rules to support insurance ordinance

)

Explore Business Standard

New rules to support insurance ordinance

)

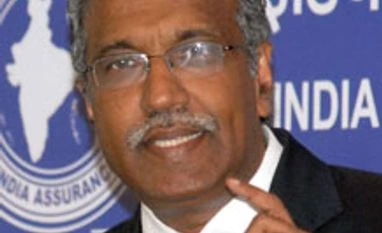

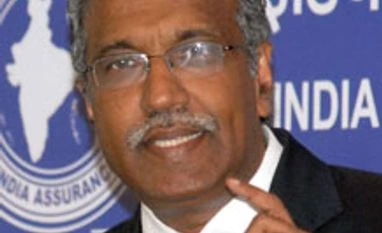

The Insurance Regulatory and Development and Authority of India (Irdai) plans to bring out a host of new regulations to support the Insurance Laws (Amendment) Ordinance. Irdai Chairman T S Vijayan said about 40 regulations would undergo changes or replaced with fresh regulations in the next few months. He added with the ordinance promulgated, global reinsurance companies were likely to open branches in India.

“Apart from the changes in the foreign direct investment, there are several changes in the Act. We are in the process of formulating appropriate regulations to support this framework,” he said on the sidelines of the Global Conference of Actuaries here on Monday.

Vijayan said the ordinance had given more freedom to insurance companies to appoint agents and also put corporate agents into the intermediary space. He added the regulator would bring out regulations on expense management as well. Giving his keynote address at the Conference, Vijayan noted how some insurance products were made complex, making them vulnerable to misunderstanding and mis-selling.

He added that through technology, insurance products would be made more affordable. Citing the examples of Common Service Centres, insurance repositories and use of Aadhaar card, he added these would the game-changers for the insurance sector.

Vijayan also raised concerns about unregulated entities operating in the insurance space with opaque compensation structures. According to him, there should be early identification of these and information about such activities should be immediately passed on to the regulator. He said the control of expenses would become very important, especially now that newer investors would be coming into the country. Vijayan said the tendency to have premiums lower than burning costs (estimated cost of claims in the forthcoming insurance period) in some group businesses should also be curbed.

First Published: Feb 03 2015 | 12:49 AM IST