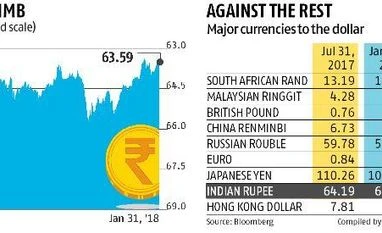

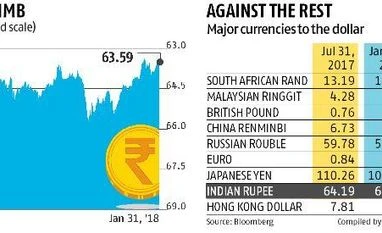

In the past six months, the Malaysian ringgit has risen 9.8 per cent in the past six months against the dollar, South African rand has risen 11.36 per cent, but rupee has strengthened only 0.94 per cent.

That makes rupee one of the most stable currency in the region, or in emerging markets, and one of the worse performers too. The underperformance of rupee is perhaps good news for the export sector, as the country’s competitiveness edges forward, but considering India is an oil-importing country, a strong dollar helps contain inflation.

Other emerging market currencies have rallied as the US government is now tacitly approving a weak dollar. But this will have varied implications for India, in terms of its attractiveness as a market to foreign investors, and thereby inflows, inflation, exports, and imports.

The US dollar was already under pressure since November last year. Last week, US Treasury Secretary Steven Mnuchin endorsed a weaker dollar, stating that it would be favourable for the exports of the largest economy of the world.

The dollar index, which measures the greenback’s strength against major currencies, fell below 89, a three-year low on Friday. Predictably, euro rose to a three-year high, while yen rose to a four-month high against the dollar. The dollar index hit a low of 88.4380 after Mnuchin’s comments against its 52-week high of 102.26.

In a year, the fall in index has been more than 11 per cent. On Monday, the dollar recovered some of its strength, but the index is still below 90, while the consensus is that it would fall in the coming days.

All emerging market currencies, at least those who directly compete with India to attract foreign investment, have strengthened against the dollar in the past six months. Surprisingly, the Indian rupee has remained a laggard in this regard.

The reason for the rupee’s relative sluggishness is rising oil prices. However, a correction in overvalued rupee was long overdue. The real effective exchange rate (REER) of rupee continued to remain high but should cool down against the trading partners as they strengthen, whereas the rupee remained relatively stable.

“While the rupee has strengthened against the dollar, it has actually weakened against euro, pound, and other currencies. Overall, our REER, on a 36-currency basis, has remained at the 118-121 range for a while now,” said Ananth Narayan, senior currency market observer.

The dollar weakness though, is good news for emerging markets, especially India as a weak dollar would bring more foreign funds to India equities and, depending upon the space availability, in debt. In the current fiscal so far, foreign investors have poured in about $19 billion in domestic debt segment, almost exhausting their limits in both government and corporate bonds.

When overseas investors invest in India, they worry about currency depreciation risk which may not be there when Dollar is projected to remain weak.

Nigam Arora, a US based fund advisor and author of prominent Arora Report, said, “India is a secular growth story. Domestic growth will continue. If rupee becomes slightly stronger, it will help control inflation in India without raising interest rates. We are advising US investors to look at India after a bounce in dollar index from its three-year low, due to dollar’s oversold condition.” Arora also sees Indian equities to be in overbought condition.

This means, at every correction in Indian equities, and with dollar remaining weak, funds from US should pour into India.

“With Indian currency strengthening or even remaining stable more funds would flow to Indian equities and debt,” said Nirmal Jain, chairman of IIFL Group.

A stable currency in invested market eliminates the risk of currency risk, and if the currency appreciates, the investor gains.

However, the increasing flows, and a stable currency has potentially increased the risk in the financial system as most of the money are unhedged.

“Standalone, we do have a problem of growing unhedged exposures in USDINR. The foreign currency purchases by the RBI during this fiscal year cannot be accounted by permanent flows of CAD, FDI and FPI in equity — in fact, oil prices have driven our CAD to a five-year high this year,” Ananth Narayan said.

“Instead, we have seen substantial carry seeking inflows from FPI in debt, exporter selling, NRE (non-resident external) deposits and speculative positions. These are vulnerable to reversal if we see any global or domestic negative shocks,” Narayan said.

According to Arora, while a weaker dollar is good for US stocks in the short term, as the earnings of the companies go up, the dollar has also been the world’s reserve currency. A lower dollar endangers the reserve currency status. And low dollar will add to inflation which means the US Fed will accelerate raising its rates, which would be a bad news for most asset classes worldwide.

)

)